Stripe

Overview

Stripe is a multi-currency enabled payment processor that supports processing credit cards and ACH payments. They support 46+ countries and 135+ currencies.

A fun fact about Stripe, their average up-time score is 99.999 percent. That means you can avoid downtime losses and rely on getting paid when you expect!

How to Connect

Steps to connect Stripe and ChargeOver together are below!

In Stripe

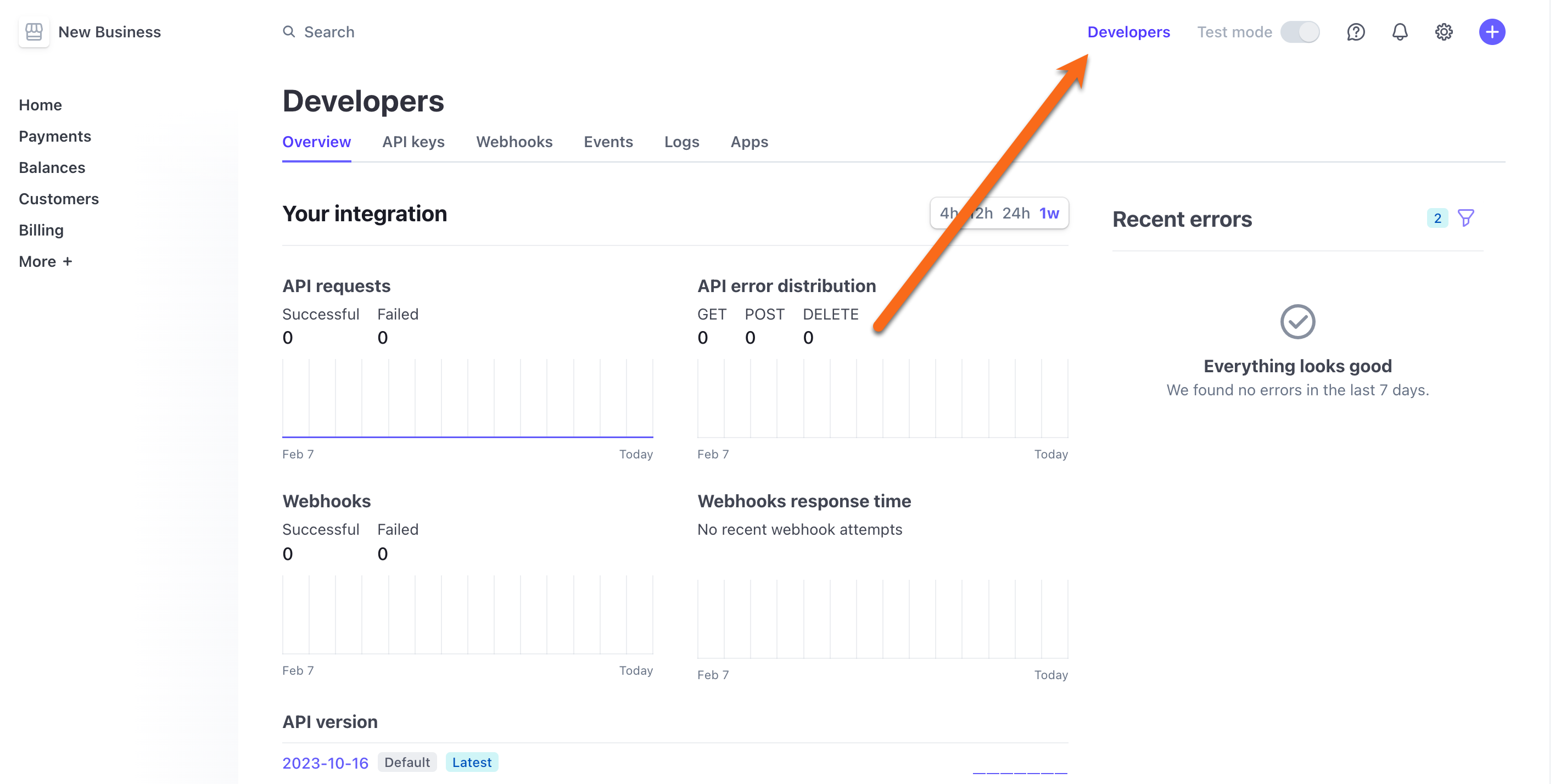

- Login to your Stripe account and select the

Developers tab

- Select the tab

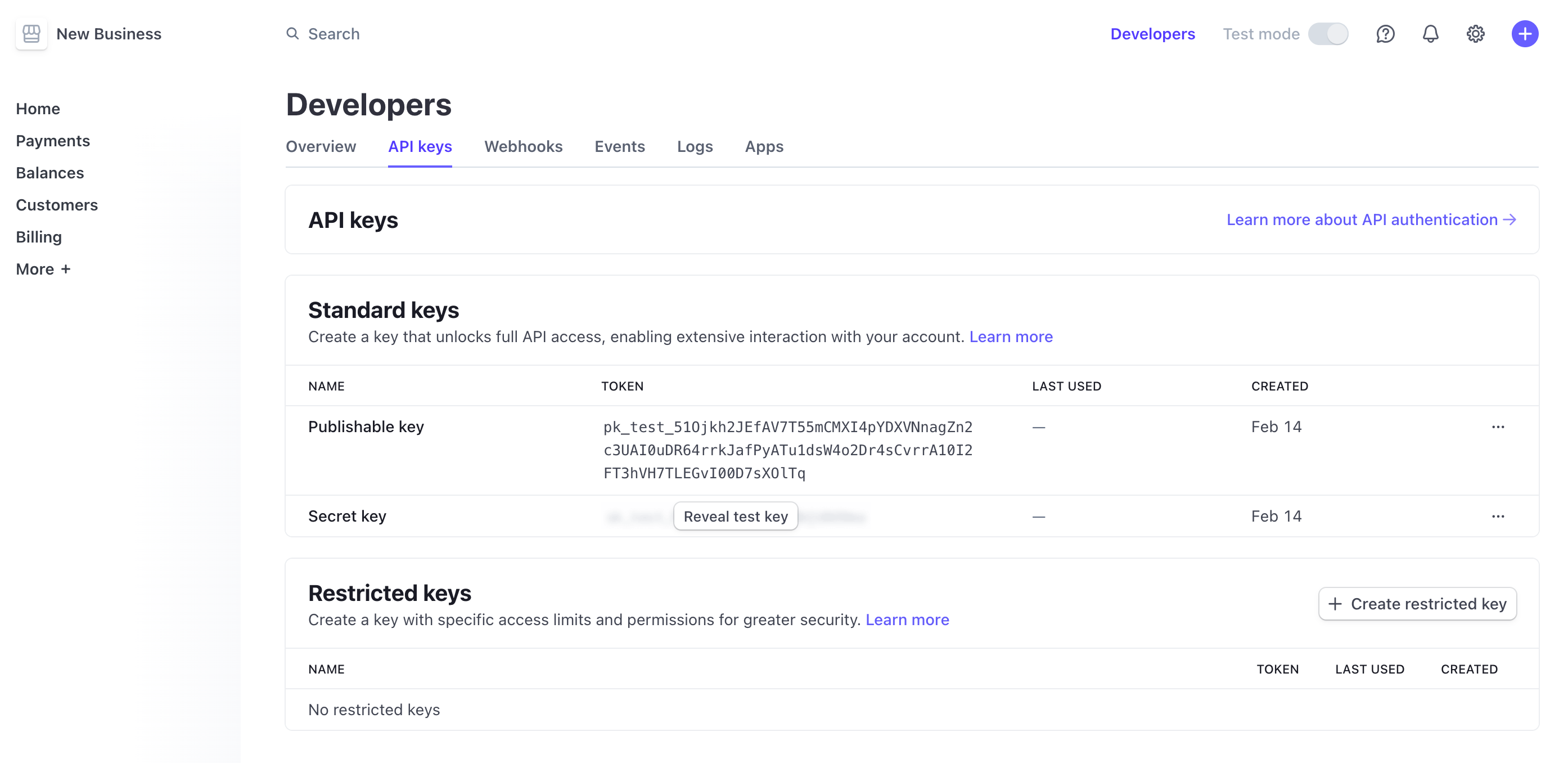

API Keys and you will see your Secret Key and Public Key

The Secret Key should always start with either sk_live_ or sk_test_.

- Once you have copied your Stripe Secret Key and Public Key you can go back to ChargeOver and finish the connection to Stripe

If you are testing, you should use the Test Secret Key. And if you are charging real payments, you should use the Live Secret Key.

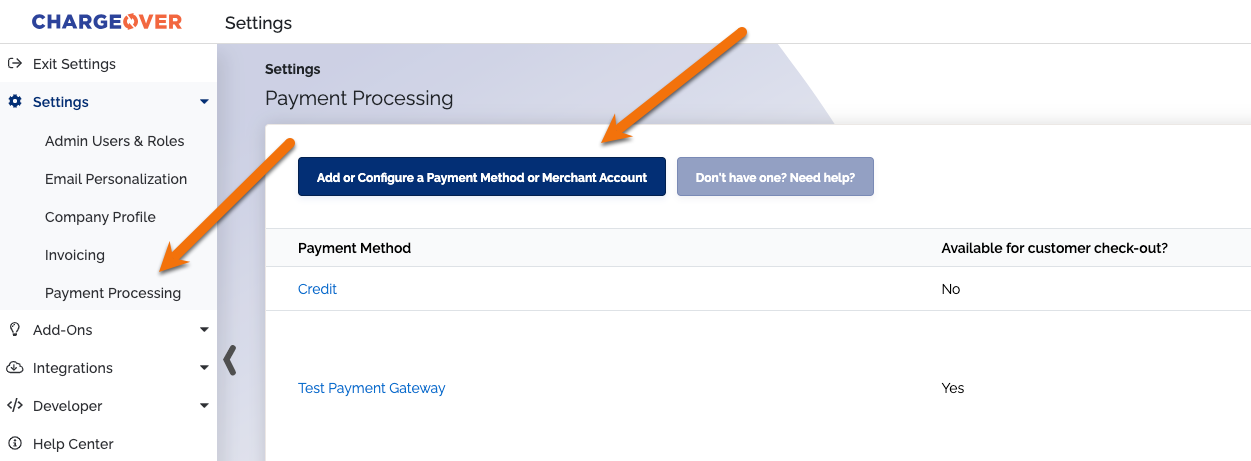

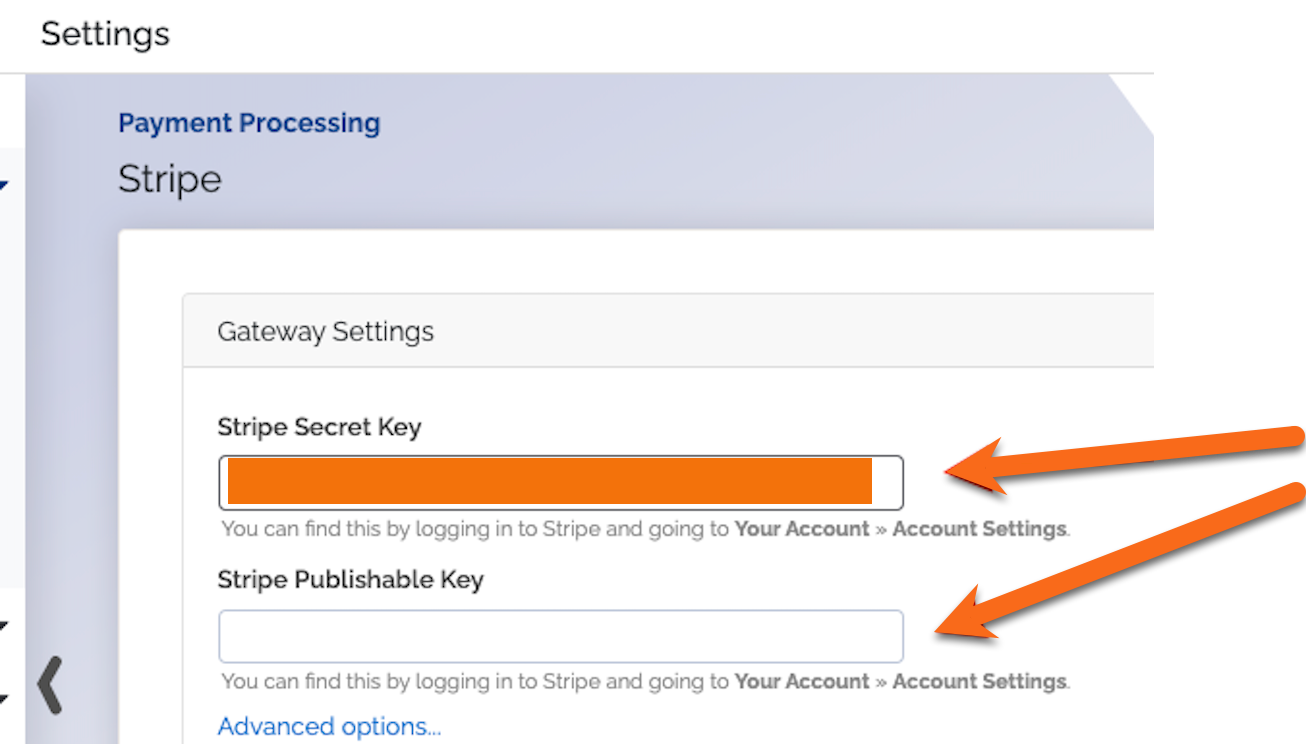

In ChargeOver

- Go to your Settings and select

Payment Processing - Select

Add or Configure a Payment Method or Merchant Account

- Find or type in Stripe in the search bar and select it

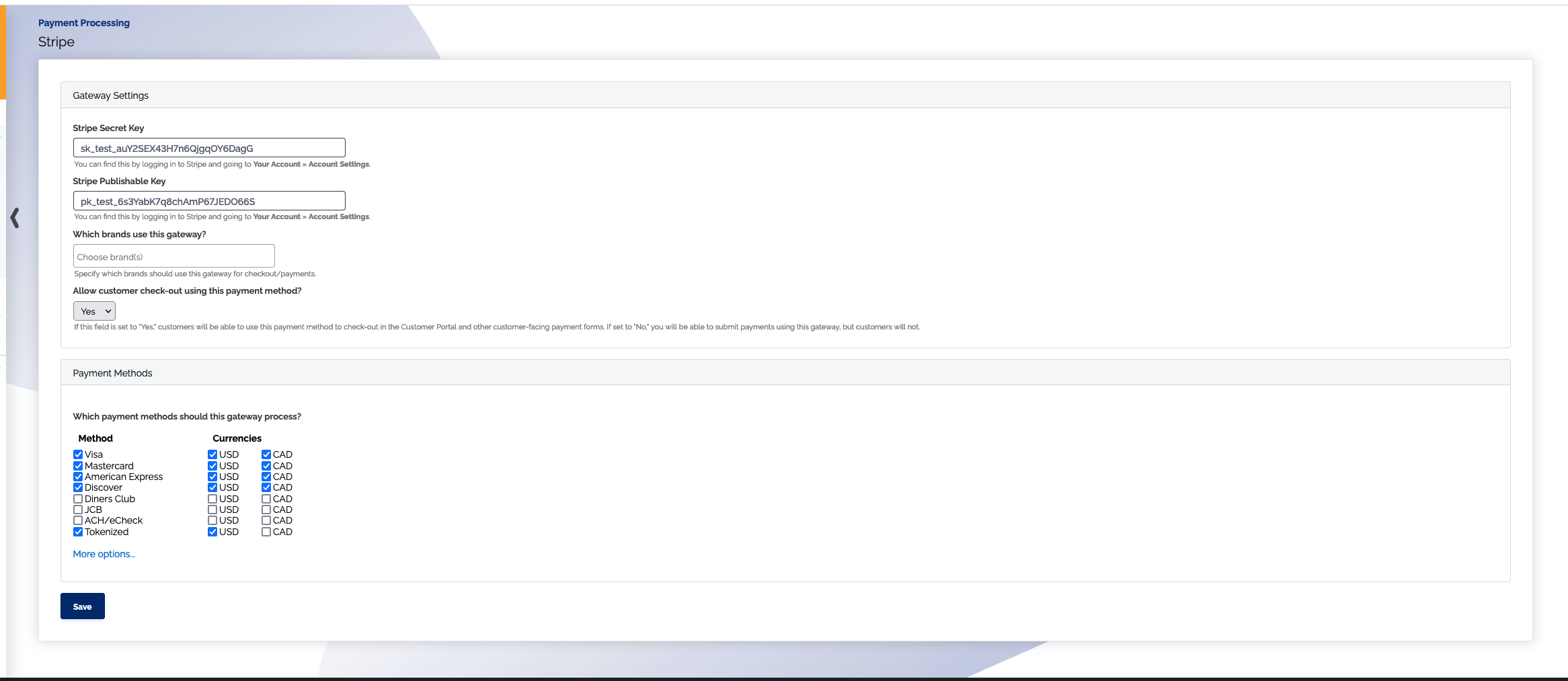

- Paste your Stripe Secret Key and Public Key

- Scroll to the next section and designate which payment types you accept (Visa, Mastercard, etc.)

Be aware that if you accept ACH payments through Stripe, your customers will need to complete the micro-verification process before their ACH account can be used to take payments.

- Click

Save Settings when finished

Common Questions

Does the integration between Stripe and ChargeOver support…

| Feature | Supported? ✅ |

|---|---|

| Dynamic Statement Descriptors | ✅ |

| Tokenized Payments | ✅ |

| Credit Card Payments | ✅ |

| ACH (USA Only) Payments | ✅ |

| EFT (CAD Only) Payments | ✖️ |

| ACH (AUS Only) Payments | ✖️ |

| Credit Card Refunds | ✅ |

| ACH Refunds | ✅ |

Can Stripe send multiple ACH or EFT payments into a single settlement batch?

✅ Yes! Stripe does this automatically!

Can Stripe report ACH payment status' to ChargeOver?

✅ Yes!

Does Stripe support same-day refunds for credit cards?

✅ Yes!

Does Stripe support same-day refunds for ACH?

✅ Yes!

Stripe now supports prior authorizations and captures, as well as credit card verifications.

Supported Currencies

ChargeOver accepts these currencies with Stripe.

AUD, CAD, GBP, NZD and USD.

Supported Merchants Countries

These are based on where your business is located.

Australia, Canada, New Zealand, the United Kingdom and the United States.

Check out Stripe's global availability page to learn more.

Keep in Mind

Any limitations this gateway may have with ChargeOver or anything you should know about Stripe that might prevent your successful payment processing with them, are listed here.

Stripe's Restricted API Keys

ChargeOver will work with standard keys, or restricted keys.

For restricted keys, you will want to make sure ChargeOver can read or write the following:

- Charges

- Customers

- Tokens

- Disputes

- Balance

Secret Key and Publishable Key Options

With Stripe, ChargeOver can operate in two different modes that gathers different information. You can:

Enter the secret and publishable key in ChargeOver. This will let us use Stripe's collection forms, which enables SCA compliance for Europe, and also enables Stripe Radar fraud detection

Enter just the secret key in ChargeOver. We will use ChargeOver's forms, meaning they will have no SCA compliance, or Stripe Radar

Stripe ACH Micro-Deposit Verification Process

Before you can accept ACH payments from a customer through the Stripe payment gateway, Stripe requires that their bank account be verified.

ChargeOver can help you with the process of getting a customer's bank account verified through micro-deposits, so that it can be used as the customer's payment method for future invoices.

In ChargeOver

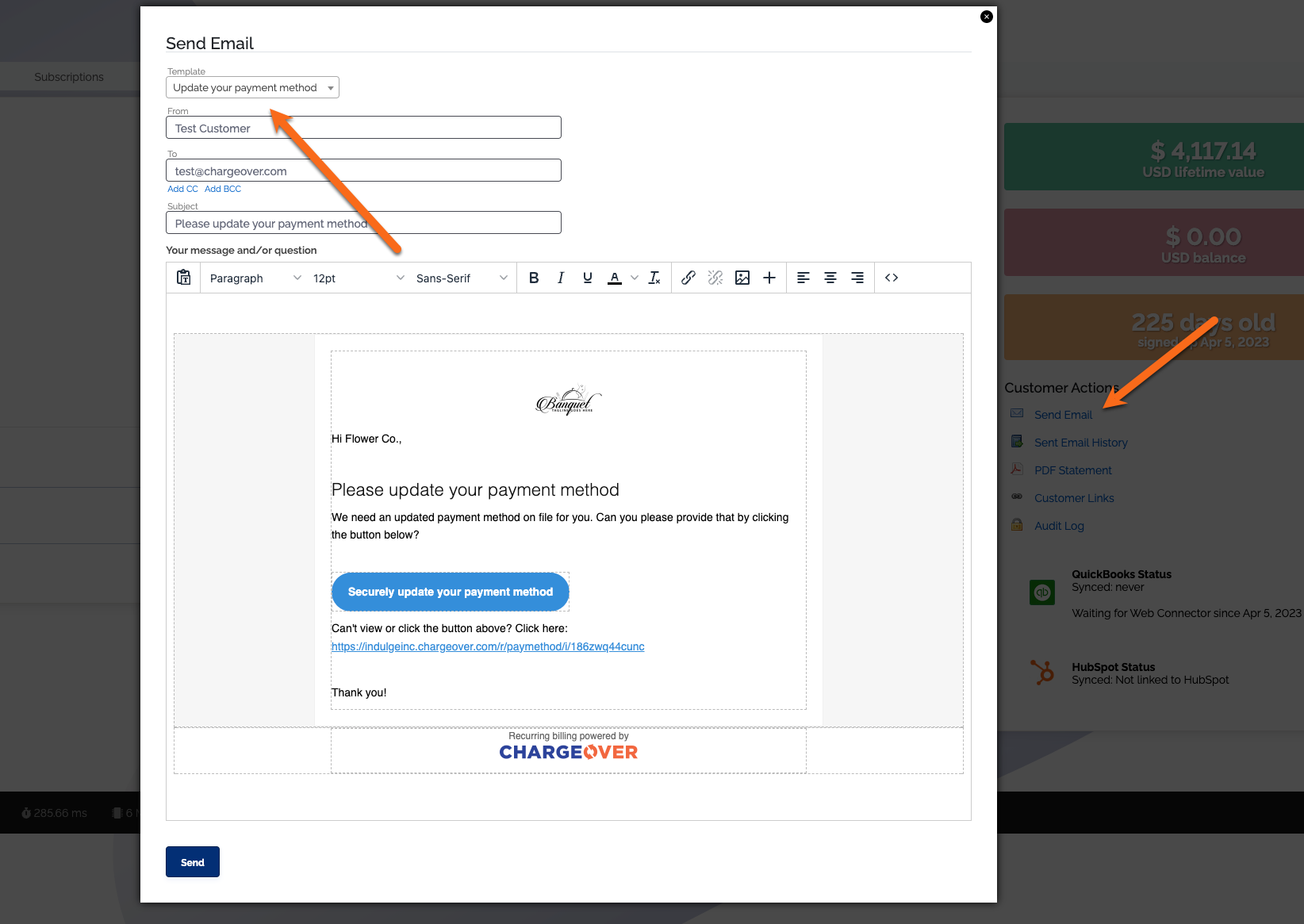

Send your customer an email with a link to update their payment method

- Go to the customers overview tab

- Select Send Email from the Customer Actions on the right hand side of the screen

- Click the Template dropdown and find the Update Your Payment Method option

- Click

Send

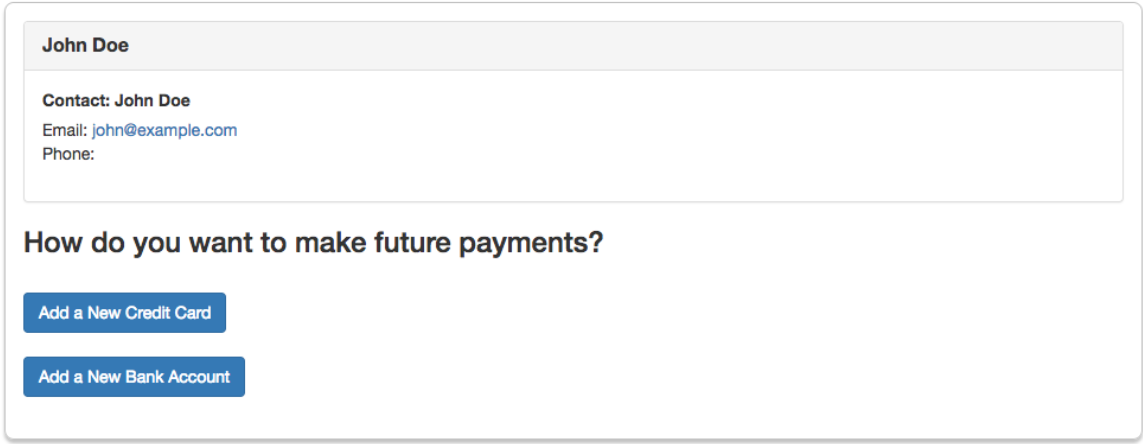

The link will bring your customer to a page like the one below. Click the

Add a New Bank Account option

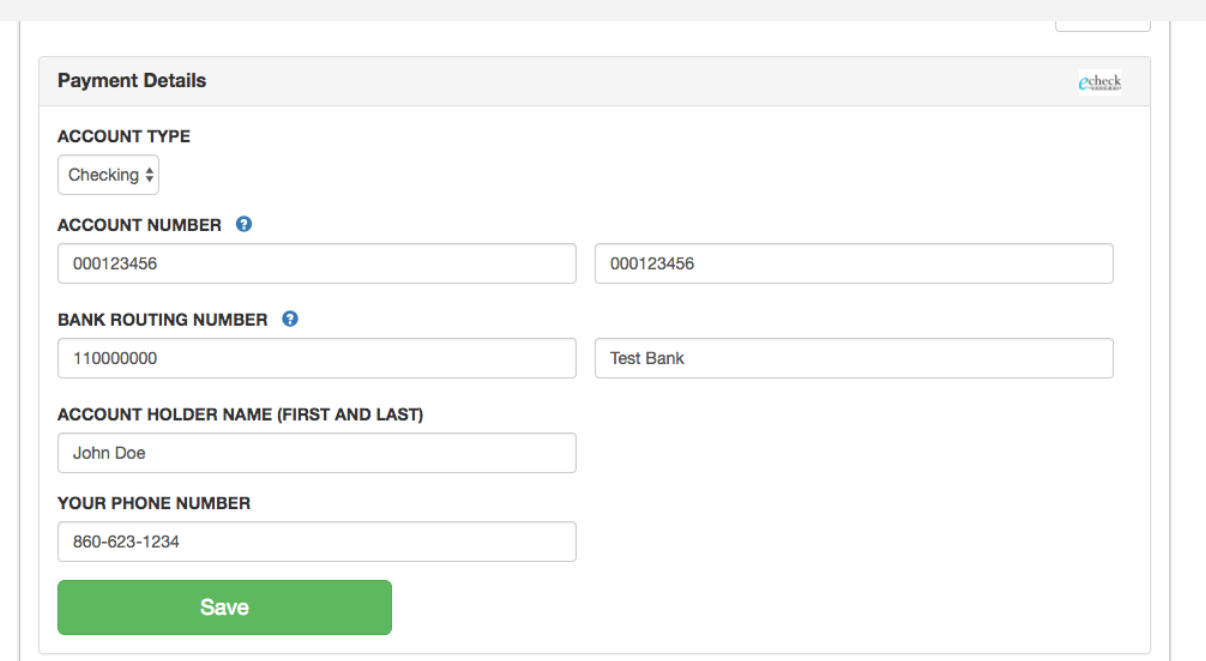

- Next, all of the customer's ACH account information will need to be filled in and saved

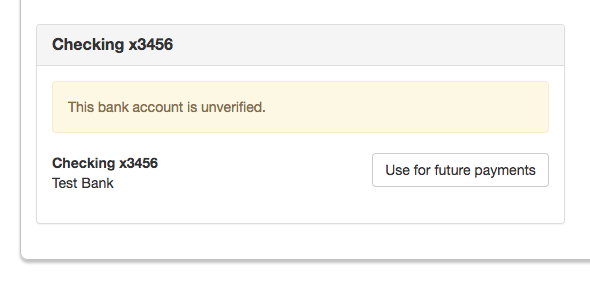

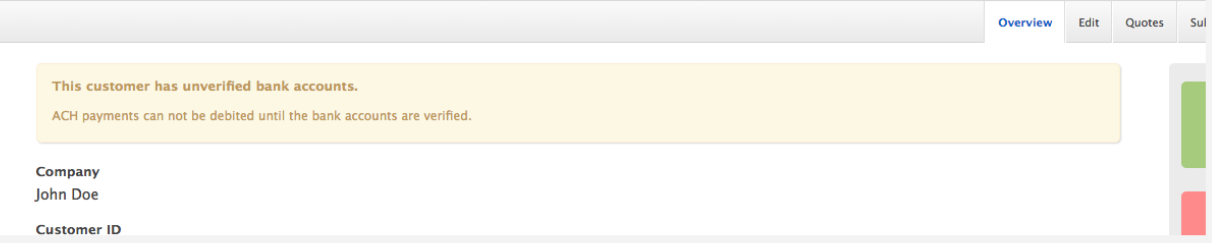

- Once the ACH information has been saved, ChargeOver will display customer facing and user facing messages indicating that the customer's bank account has not been verified yet

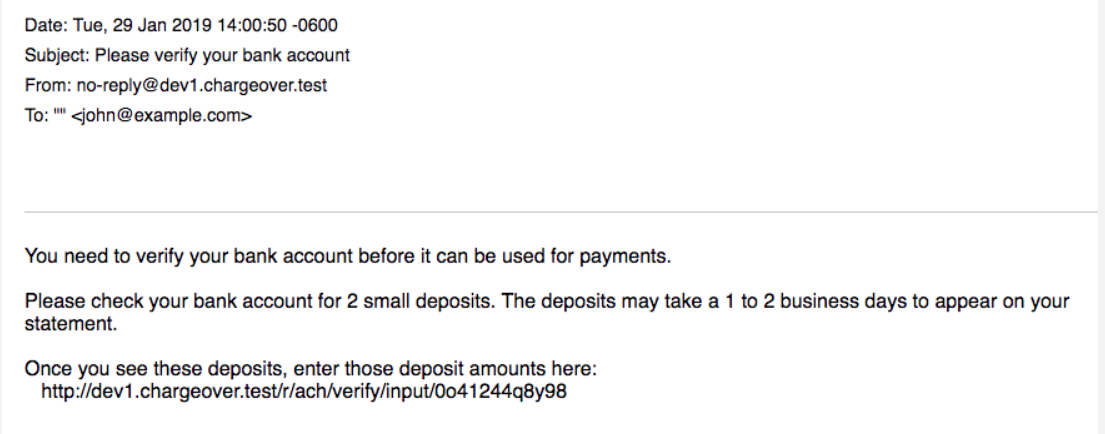

- ChargeOver will automatically send an email to the customers primary contact in ChargeOver, directing them to

check their bank account for the micro-deposits used for bank account

verification

- The email ChargeOver sends will also contain a link that the customer should go to once they see the deposits in their account

Make sure that you have an email address for the customer on file in your ChargeOver account. You can add one under their Contacts tab.

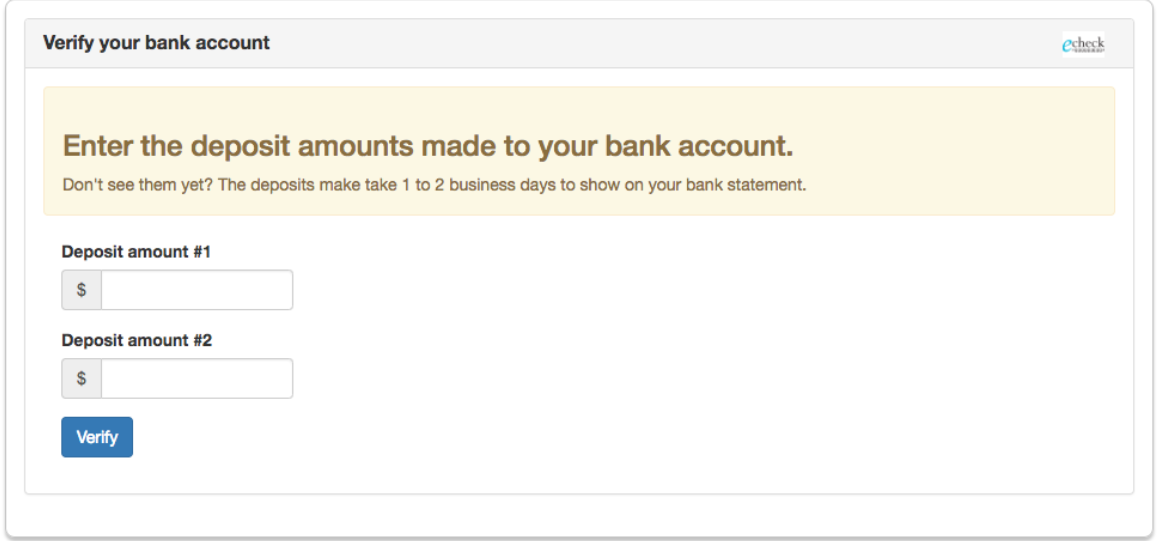

- When the customer follows the link in the email, they will be asked to input

the amount of the two micro-deposits they see in their bank account and click

Verify

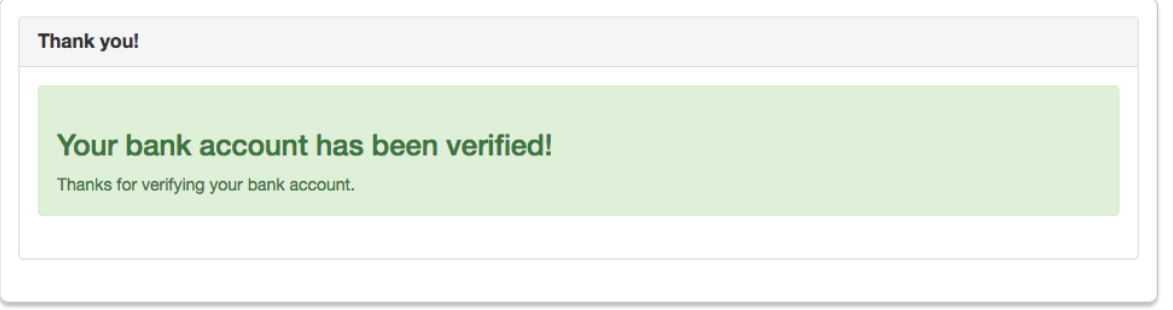

- Once the customer has successfully verified their bank account, a message will display

Once this process has been completed, the customer's verified bank account can be used towards paying their future invoices through Stripe.

Transferring Payment Tokens From Stripe

If you are wanting to transfer payment tokens from Stripe to another payment processor, you need to know that all of the payment tokens are specific to Stripe. Therefore, you will need to ask Stripe to transfer all the payment data to the new payment processor you are switching to.

After Stripe completes the transfer, the customer will need to tokenize the payment data with the new payment processor, because most of the time every payment processor has their own special formatting for payment tokens.

Dynamic Statement Descriptors

Statement descriptors explain charges or payments on your customers bank statements. Using clear and accurate statement descriptors can reduce chargebacks and disputes. Read more about Stripe's support for statement descriptors.

If you want your customers bank statements to reflect your invoice number or the name of the product purchased, you can use merge tags to push this information to their bank statements.

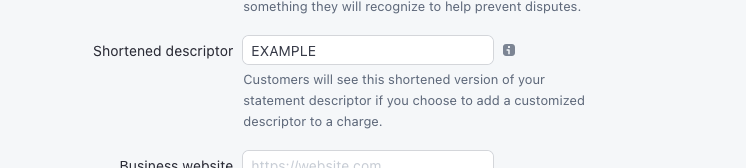

In Stripe, set your shortened prefix:

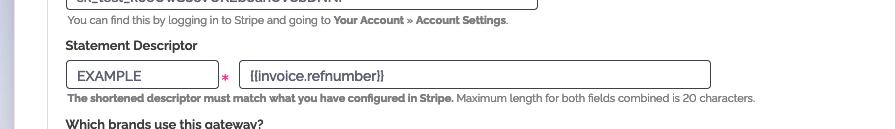

In ChargeOver, set the same shortened prefix, and the dynamic component:

These merge tags are available for use in the dynamic component only:

| Merge tag | Description |

|---|---|

| {{invoice.refnumber}} | The invoice number being paid for |

| {{customer.company}} | The customer name |

| {{line.item_name}} | The product name of the first invoice line item |

| {{line.descrip}} | The description of the first invoice line item |

Due to technical limitations, if you're using Stripe and you have to process all credit card types (e.g. Visa, Mastercard, Amex, and Discover) via Stripe.

For example, you will not be able to process Visa through Stripe and Mastercard through Authorize.net.

Contact us if this is problematic for you, and we can discuss work-arounds.

Common Decline Messages

If you are unsure what a Stripe decline message means or what to do next, the most common error messages you might encounter are explained below.

| Error Message | What Stripe is Trying to Tell You | Next Steps |

|---|---|---|

| ERR_DECLINE | Stripe told ChargeOver the payment was declined. | You or the customer should contact Stripe to discuss the reason for the decline. |

| ERR_CREDENTIALS | Stripe told ChargeOver that your authentication credentials for Forte are incorrect. | You should contact Stripe and fix the credentials you use to connect to them. |

| ERR_EXPIRED | Stripe told ChargeOver the credit card has expired. | You should contact the customer and ask them to provide a new payment method. |

| ERR_CVV | Stripe told ChargeOver the credit card was declined due to an incorrect CVV/CVC security code. | Your customer should provide a correct CVV/CVC security code, or provide a new payment method. |

Troubleshooting Connecting

While the new Stripe Connect method provides some advantages, it also has a

disadvantage. You can get an error message like the one below.

This error message can either be found on the object, like the payment or refund, or the Stripe connection page in ChargeOver.

Error Message

Requests made on behalf of a connected account must use card tokens from Stripe.js, but card details were directly provided.

What Stripe is Trying to Tell You

If you connect to ChargeOver via Stripe Connect, then Stripe does not let ChargeOver send full credit card numbers to Stripe. Instead, Stripe forces ChargeOver to use Stripe's UI elements to collect the credit cards.

The only time this could be problematic is if you're trying to send full credit card numbers to ChargeOver, through ChargeOver's REST API, or if you are hosting your own sign-up forms, instead of using ChargeOver's built-in ones.

Next Steps

- In ChargeOver, go to your Settings, then

Payment Processors and Stripe - Remove the Stripe Secret Key and Public Key

- Go to Stripe and get both keys

- Do not use the

Connectbutton within ChargeOver to connect

- Do not use the

- Copy and paste your keys from Stripe, into ChargeOver

Stripe Support

If you need to contact Stripe's support team, you can use the information below.

Stripe has a live chat where you can ask questions!