Write-Offs

Overview

If you know you'll never receive payment for part or all of an invoice, you can write off the balance of the invoice.

To write off the balance of an invoice, you'll first have to enable the write-offs feature in your account.

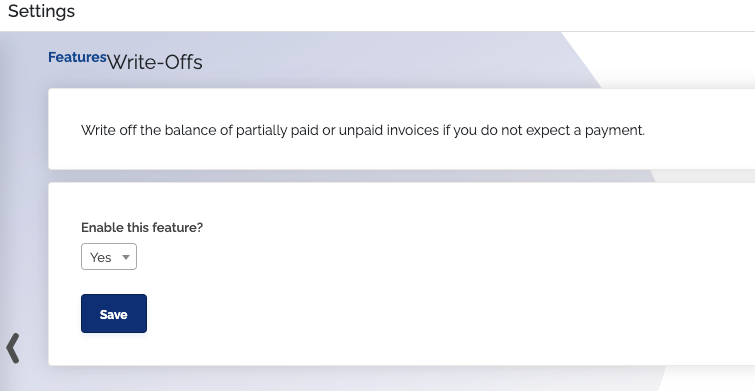

Enable write offs

- Go to

Features and search for "Write-offs", then clickGet Started - Set enable this feature? to Yes

- Click

Save

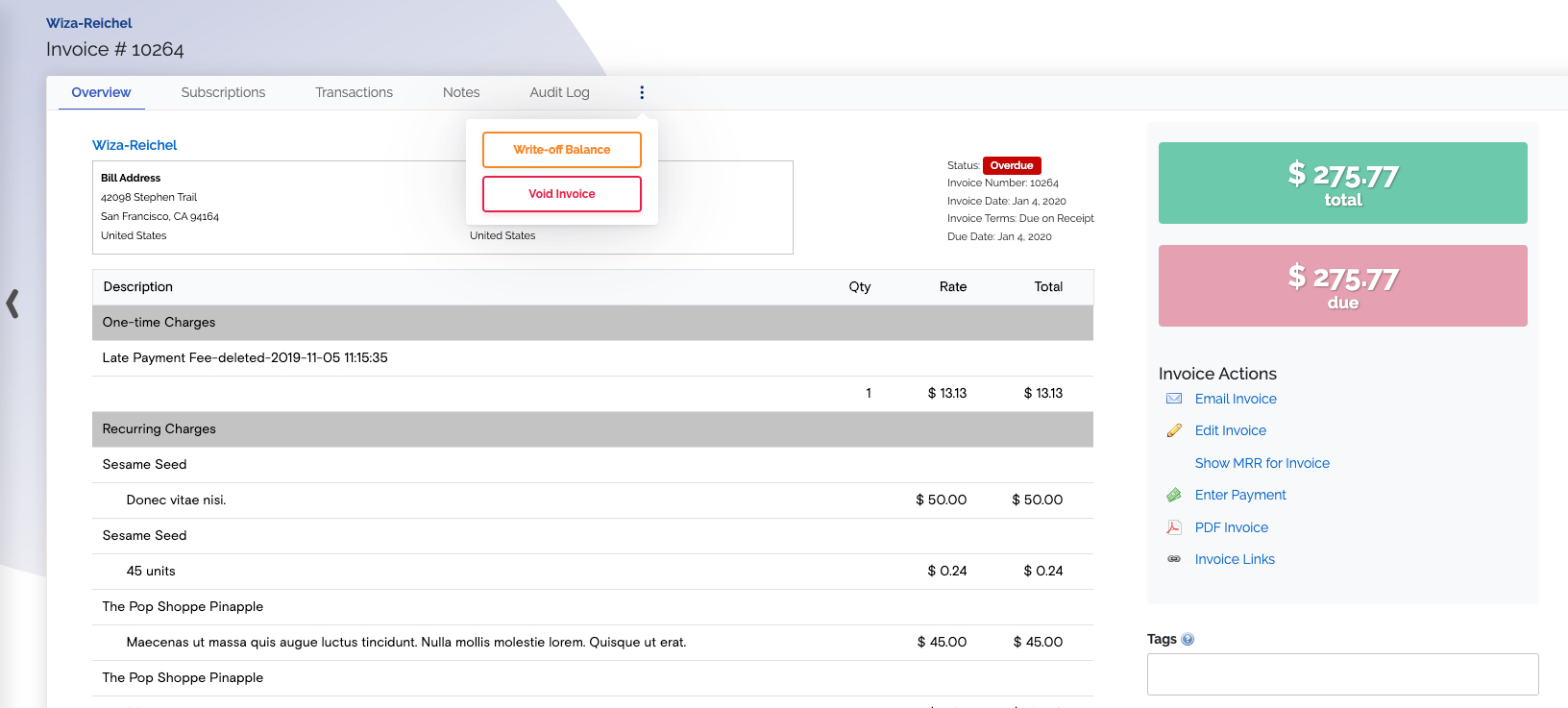

Mark an invoice as a write-off

- Go to the invoice and make any payments you can against the invoice first

- Click the three vertical dots and select

Write-off Balance

Once you write off the balance, the invoice will be marked paid, and the written-off portion of the invoice notated in the transaction history.

Write-offs do not currently sync to QuickBooks desktop, QuickBooks Online, or Xero at this time.

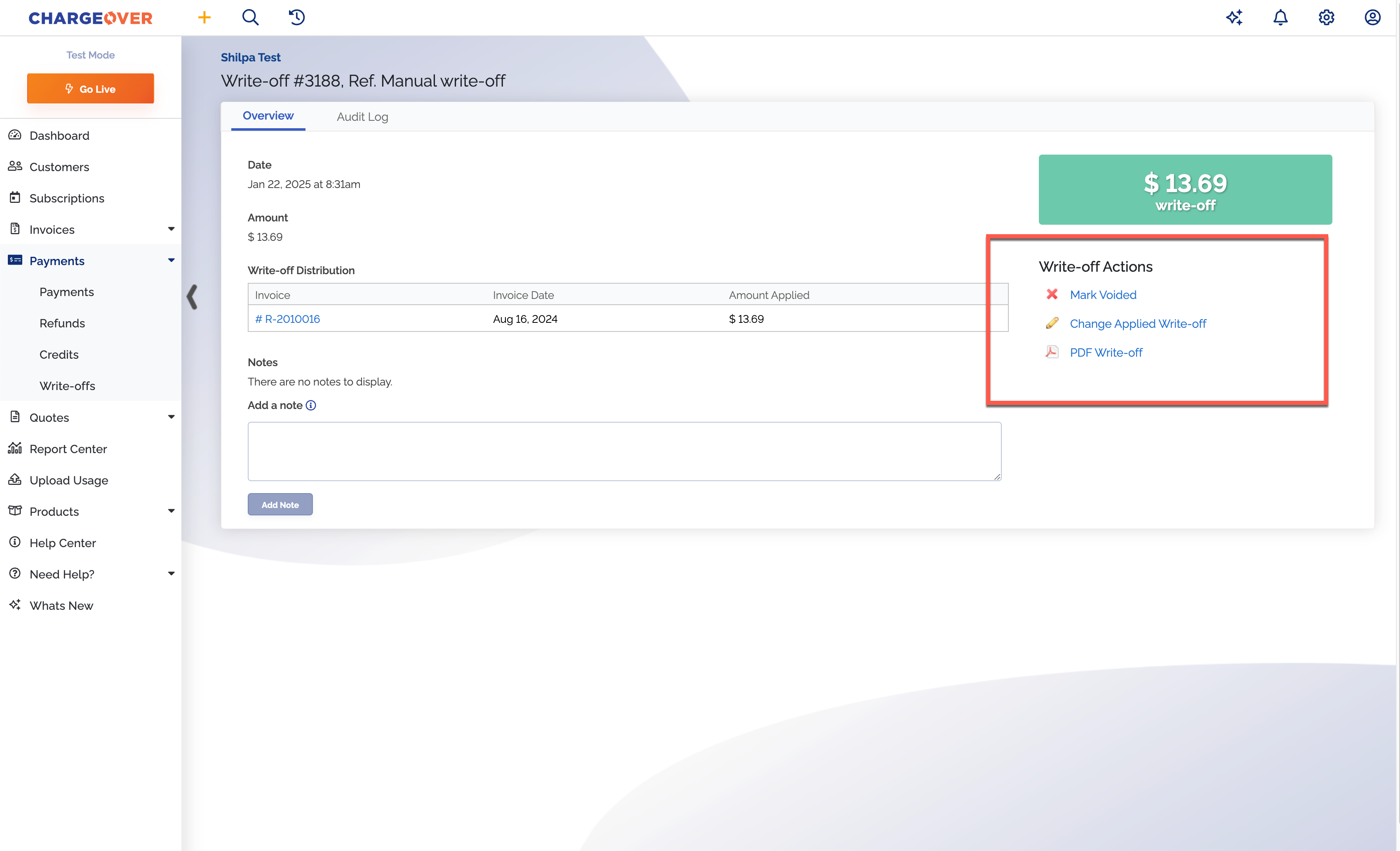

Write-off actions

There are a few different actions underneath a write-off. They include the following.

"Mark Voided" - This will void or cancel your write-off

"Change Applied Write-off" - This will let you edit how much of your write-off is applied to specific invoices

"PDF Write-off" - This will let you download a PDF copy of your write-off