Rev rec with QuickBooks

ChargeOver will automatically calculate deferred and recognized revenue totals.

To track this data in QuickBooks as well, you will want to journal entry deferred revenue to recognized revenue each month in QuickBooks.

Are you trying to use QuickBooks Online Advanced's built-in revenue recognition reports?

Recognizing revenue from ChargeOver, in QuickBooks

To make sure your QuickBooks chart of accounts has accurate balances of deferred and recognized revenue, you will need to enter a journal entry in QuickBooks once per month to recognize revenue.

After month end each month, you can find the amount of revenue that should be recognized in any of the ChargeOver revenue recognition reports.

- After month end, each month...

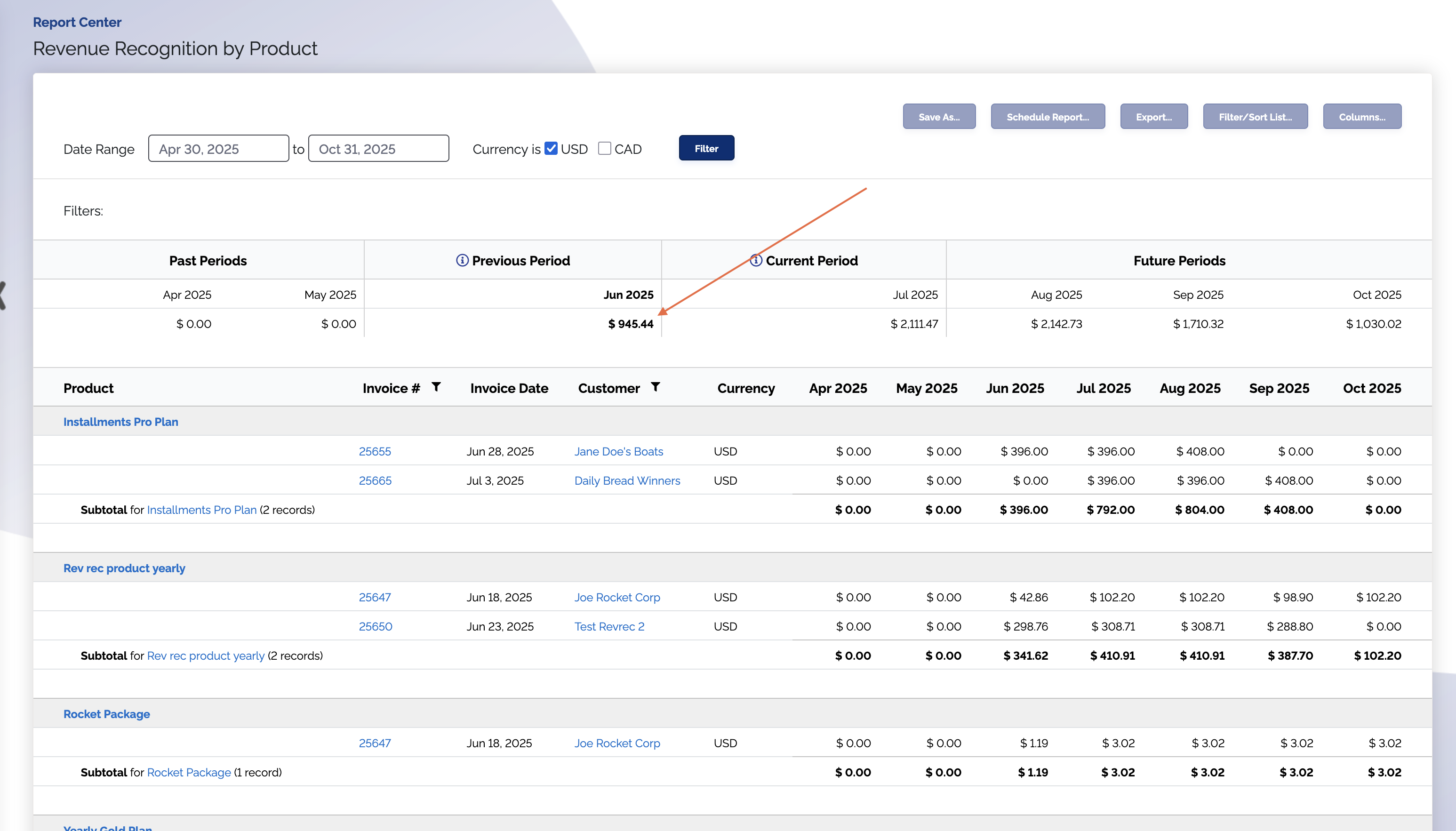

- Navigate to the Report Center in ChargeOver, and choose any revenue recognition report

- Find the Previous Period total at the top of the report

The Previous Period total is the amount of revenue that should be recognized for the previous month.

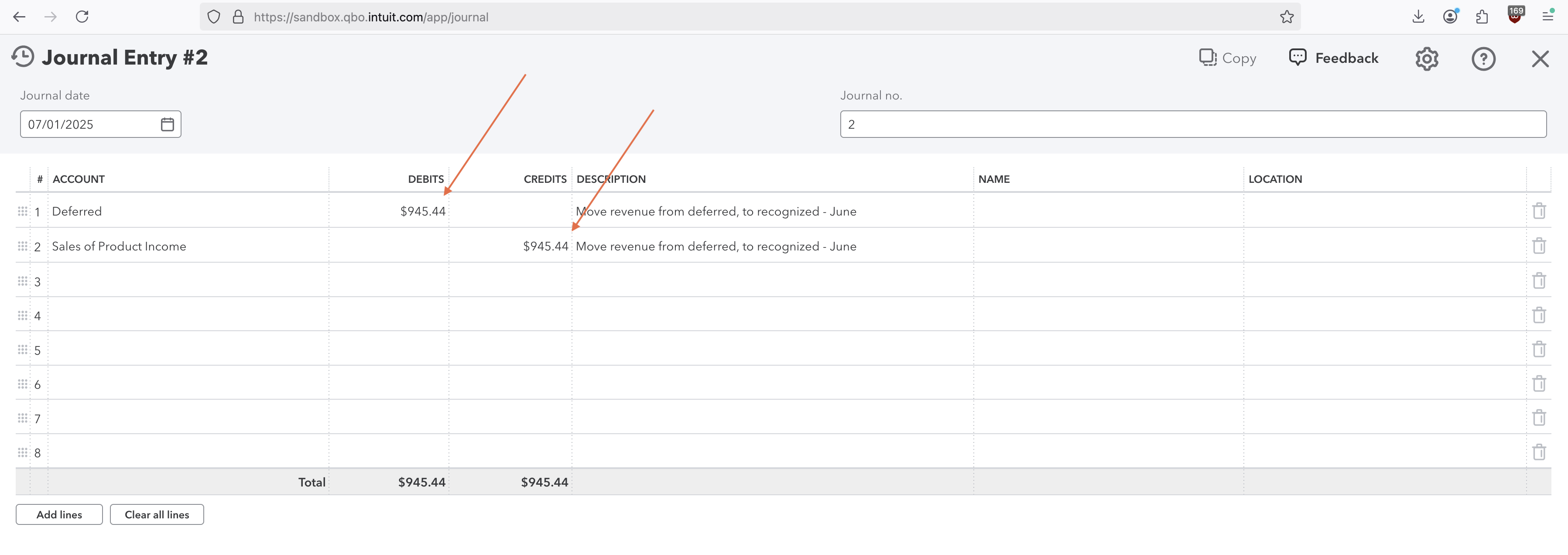

- In QuickBooks, create a journal entry to move the previous period total from

your deferred revenue account in QuickBooks, to your recognized revenue account

(usually

SalesorIncome, but the name may vary business-to-business).

That's it!

Notes about QuickBooks Online Advanced

Some editions of QuickBooks (for example, QuickBooks Online Advanced) have some limited

built-in revenue recognition support, but will produce less detailed and less accurate

reporting when compared to ChargeOver.

For the most accurate reporting, use ChargeOver's revenue recognition reporting.

ChargeOver will still sync the required data to QuickBooks Online Advanced so that

you can get reporting directly from QuickBooks as well, but the reports may not

match exactly between QuickBooks and ChargeOver. QuickBooks does not currently have

a way for ChargeOver to communicate:

- Installment method revenue recognition

- Completed-contract method revenue recognition

- Sales-basic method revenue recognition