Revenue Recognition

Revenue recognition is an accounting principle that dictates when and how a company records revenue in its financial statements. It focuses on recognizing revenue when it is earned, rather than just when cash is received. This ensures that financial statements accurately reflect a company's financial performance and position.

ChargeOver can automatically calculate GAAP- and ASC606- compliant deferred and recognized revenue using a number of different revenue recognition methods.

Enabling revenue recognition

To enable revenue recognition in ChargeOver:

- Go to Settings then

Features thenMore Features - Search for "Revenue Recognition" and click the

Get Started button - Set "Enable Revenue Recognition?" to "Yes" and click

Save

After enabling revenue recognition, you'll need to configure your products for revenue recognition.

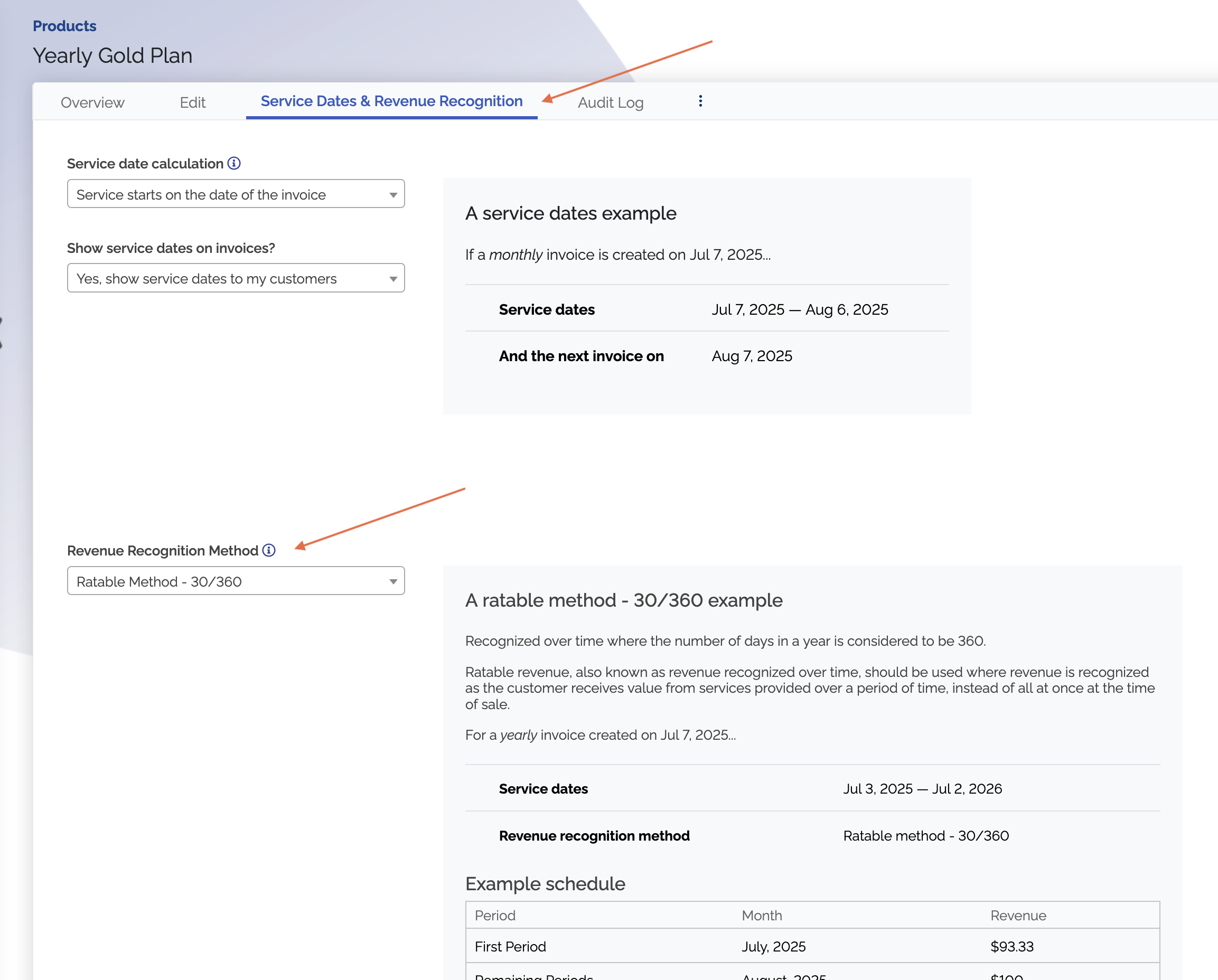

Configuring revenue recognition methods on a product

ChargeOver needs to understand how you will recognize revenue for each product you want to calculate revenue recognition schedules for.

- From the left-side menu in ChargeOver, choose the Products option

- Click the product you want to configure revenue recognition for

- Choose the Service Dates & Revenue Recognition tab

- For Ratable (subscription) products, choose a service date calculation method

- Choose a Revenue Recognition Method from the dropdown

- Click the

Save button

Read more about support revenue recognition methods.

Viewing revenue recognition for an invoice

When viewing a specific invoice, you can choose the Revenue Recognition option to view the revenue recognition schedule for that specific invoice.

ChargeOver will show you the revenue recognition method, service dates, and schedule:

- Revenue - the Revenue column shows you the amount of revenue that will be recognized each month.

- Recognized - the Recognized column shows a running total of recognized revenue so far.

- Deferred - the Deferred column shows the remaining deferred revenue.

Reporting

Revenue recognition reporting is provided via several different reports:

Revenue recognition methods

ChargeOver supports several different GAAP- and ASC606- compliant revenue recognition methods.

Talk to your accountant or tax advisor!

Your accountant or tax advisor is your best resource for determining how your business should be recognizing revenue.

Ratable - daily

Recognized daily over time throughout the service period.

Ratable - 30/360

Recognized over time where the number of days in a year is considered to be 360 (12 months in a year, each with exactly 30 days).

Installment

The installment method is used to recognize revenue when cash is received in multiple installments over an extended period of time for goods or services delivered.

- Learn more: Installment revenue recognition, with examples

Sales basis

The sales basis method recognizes all revenue at the time of sale.

- Learn more: Sales-basis revenue recognition, with examples

Completed contract

The completed contract method of accounting recognizes all revenue when the contract is completed and the invoice is paid.

QuickBooks and revenue recognition

ChargeOver makes revenue recognition with QuickBooks Online easy. Read more.

Frequently asked questions

How are taxes/VAT recognized?

Taxes/VAT are generally not considered revenue, and are never deferred. Reporting in ChargeOver shows the pre-tax subtotals of the invoices.

How are one-time setup fees recognized?

Setup fees are never deferred, and instead always recognized immediately.

Reference

Two organizations decide and enforce the generally accepted accounting principles (GAAP):

- The Financial Accounting Standards Board (FASB)

- The Securities and Exchange Commission (SEC).

For your reference, GAAP ASC 606 is defined here: