AvaTax

Overview

If you want automated sales tax calculations, connect to AvaTax!

Avalara AvaTax works with ChargeOver to dynamically delivers instantaneous sales tax decisions based on precise geo-location in more than 12,000 taxing jurisdictions in the U.S.

Once you connect Avalara AvaTax to ChargeOver, sales tax calculations are performed automatically whenever an invoice or recurring charge is created in ChargeOver.

Never worry about changing sales tax rates or rules ever again!

Steps to Connect

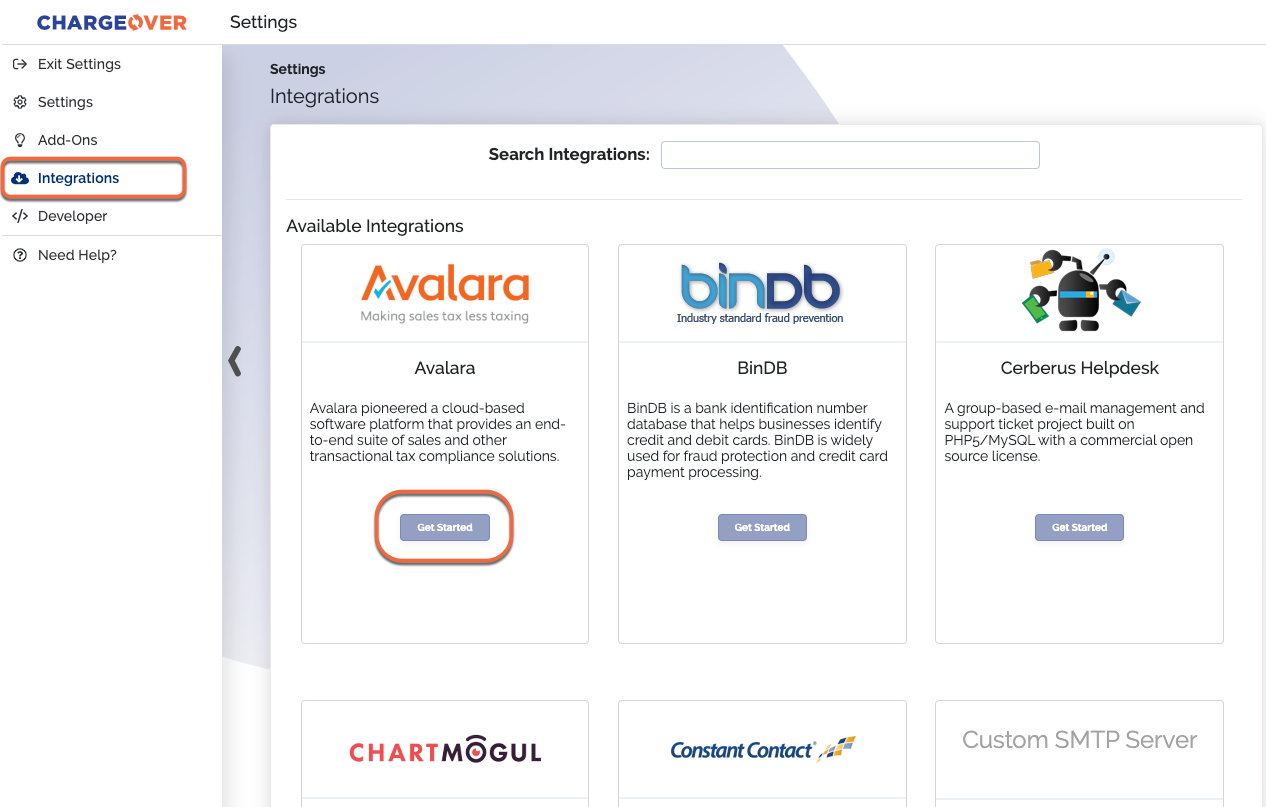

- Go to your settings, then select

Integrations then clickAvalara andGet Started

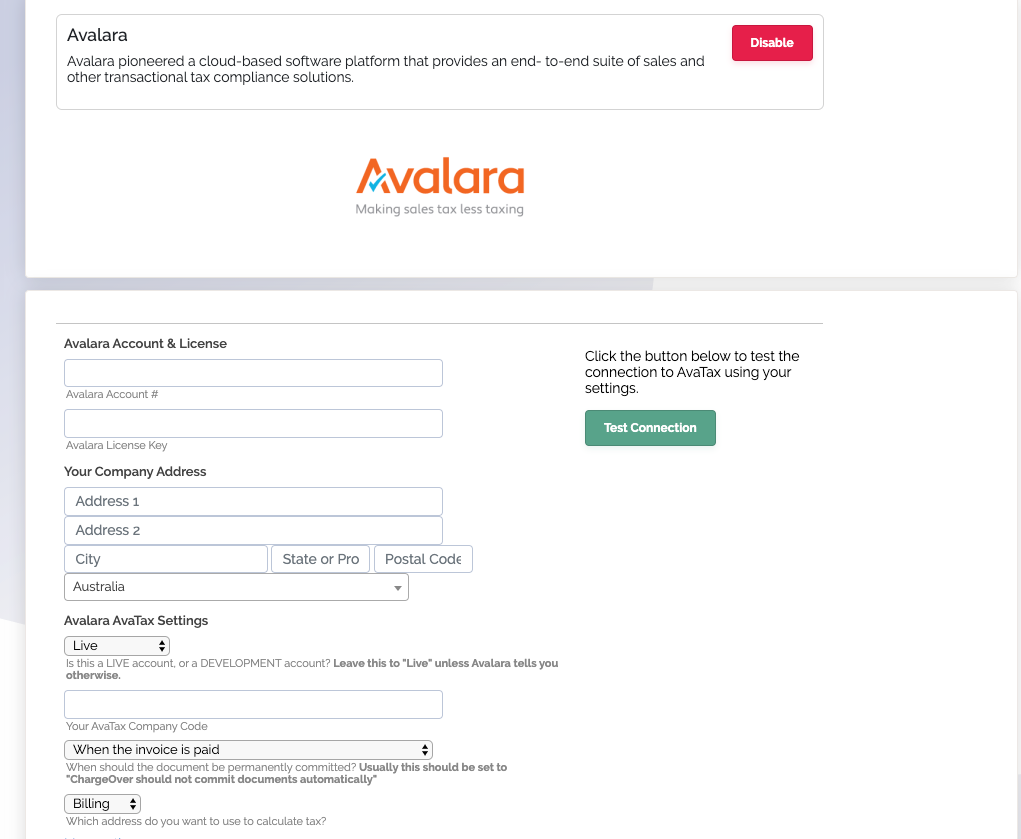

- Info AvaTax will need is

- Avalara Account #

- Avalara License Key

- Company Address

The first two should be provided by your Avalara sales rep.

- Company code

You will need this if you are using AvaTax with multiple companies.

- Usually the setting “When should the document be permanently committed," should be set to “When the invoice is paid”

- However, if you have another system connected to Avalara AvaTax in addition to ChargeOver, and that other system is going to commit the documents automatically, you may wish to choose one of the other options

- Click

Test Connection then clickSave Settings

Great, you’re connected!

Configuring Your Services or Products

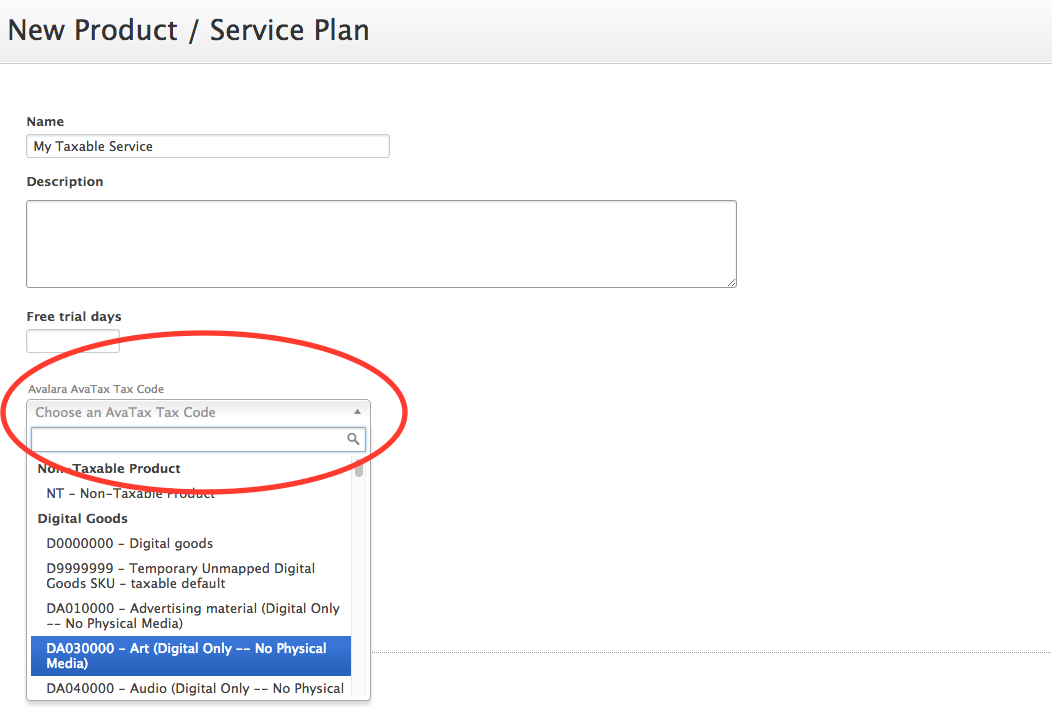

To ensure that your products and services are matched up with the correct sales tax rates, you should assign an AvaTax Tax Code to each of the products or services that you sell.

You can edit your existing products or services, and add new products/services in ChargeOver by choosing Plans & Products from the left-hand side menu.

When editing or adding products or services, you’ll see an AvaTax Tax Code menu that you can choose the appropriate code from.

Start typing in the box and the list will search for matches for you.

Creating Invoices

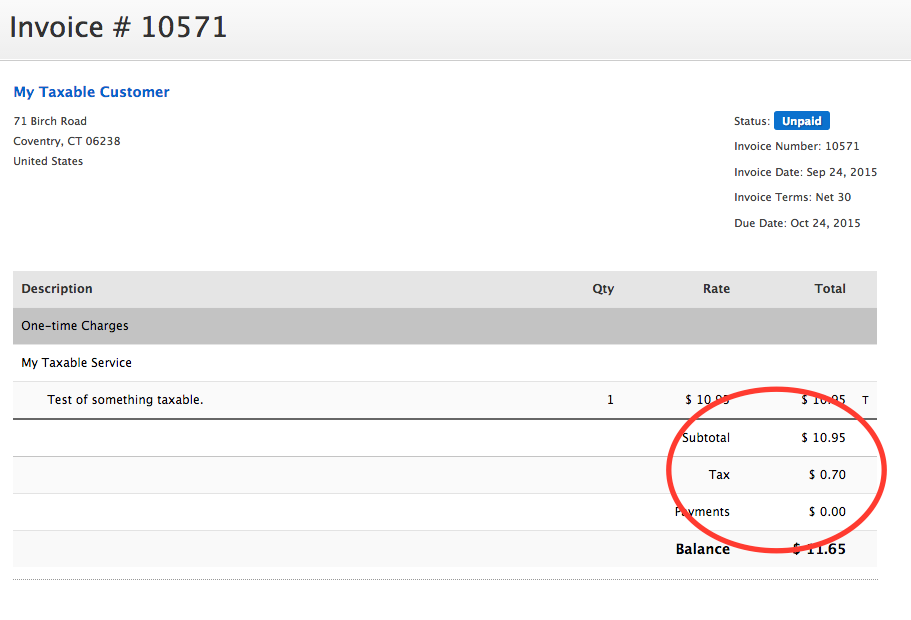

When creating invoices and recurring packages or subscriptions in ChargeOver, you don’t have to do anything special or out-of-the-ordinary.

ChargeOver will work with Avalara AvaTax automatically behind the scenes to make sure your customers are quickly and accurately charged the correct sales tax automatically.

On your invoices, you’ll see sales tax will be calculated and reflected automatically.

That’s it, sales tax for your recurring invoicing and payments is now automated!

Global VAT Tax

ChargeOver's integration with Avalara AvaTax offers real-time, accurate, automated sales tax reporting for businesses based in the United States or anywhere in the European Union.

This article specifically addresses EU-specific, VAT related sales tax settings within the ChargeOver/Avalara AvaTax global configuration.

Vat Calculation

To perform VAT calculations with Avalara, you need to provide ChargeOver one extra piece of information for each of your ChargeOver customers - VAT identification number (VATIN, or VAT #).

When adding your customers to ChargeOver, make sure to enter the VATIN of your customer in the FEIN / VAT # / Tax ID # field within ChargeOver.

If you do not specify a VAT #, Avalara will be unable to accurately calculate tax for this customer.

Keep in Mind

- AvaTax does not currently support address verification/validation for non-US businesses

- This does not impact the accuracy of VAT tax calculations, because VAT tax is not specific to an address, but instead is only based on the source and destination countries

- The currency of the invoices will be sent to Avalara AvaTax to ensure that VAT calculations are performed in the correct currency

Tax Exempt Customers

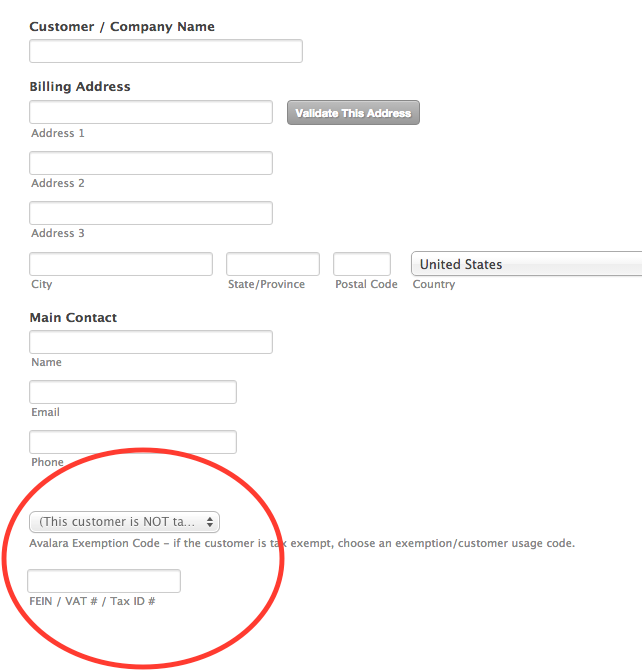

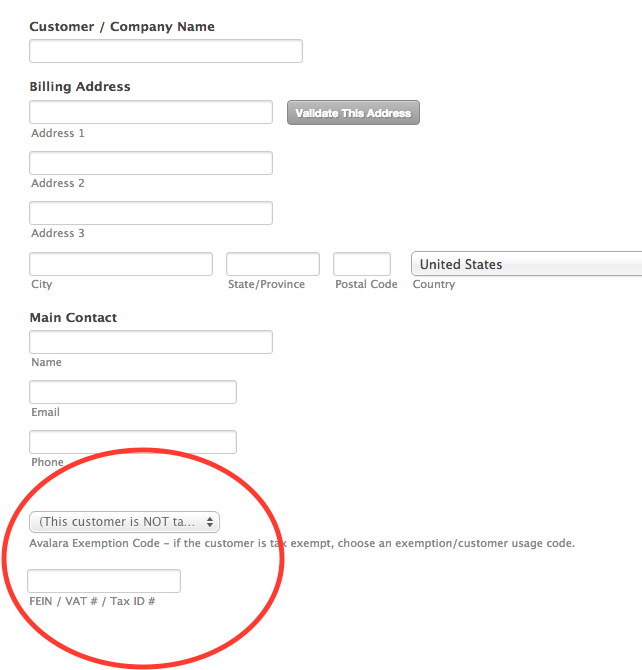

If your customer is tax exempt, you need to mark them as tax exempt in ChargeOver, so that ChargeOver can let Avalara AvaTax know not to charge sales tax.

To do this, when adding or updating customer information, make sure an Avalara Exemption Code is selected for any tax exempt customers. As long as an exemption code is specified, the customer will not be charged sales tax or VAT.

Editing Invoices in AvaTax

Whether or not tax in Avalara is labeled as "committed" determines how AvaTax is calculated in ChargeOver.

Tax is Not Committed

If an invoice is not committed yet in AvaTax, tax will be recalculated.

Keep in Mind

- The recalculation will take into account any edits that were made to the invoice

- In the audit log, you will see a reference to tax being "Calculated by AvaTax"

Tax is Committed

If an invoice is committed in AvaTax, then tax will not be allowed to be recalculated.

Keep in Mind

- ChargeOver will retrieve the previously calculated tax from AvaTax, and attempt to apply that to the invoice in ChargeOver

- If all of the lines which AvaTax has calculated tax for still exist on the ChargeOver invoice, then the previously calculated tax from AvaTax tax will be applied to the existing invoice lines in ChargeOver

- If you delete any of the invoice lines from ChargeOver, then the entire AvaTax taxable amount will be summarized and applied to the first line item on the invoice

- In the audit log, you will see a reference to tax being "Retrieved from AvaTax" instead of "Calculated by AvaTax"

Set an Effective Date

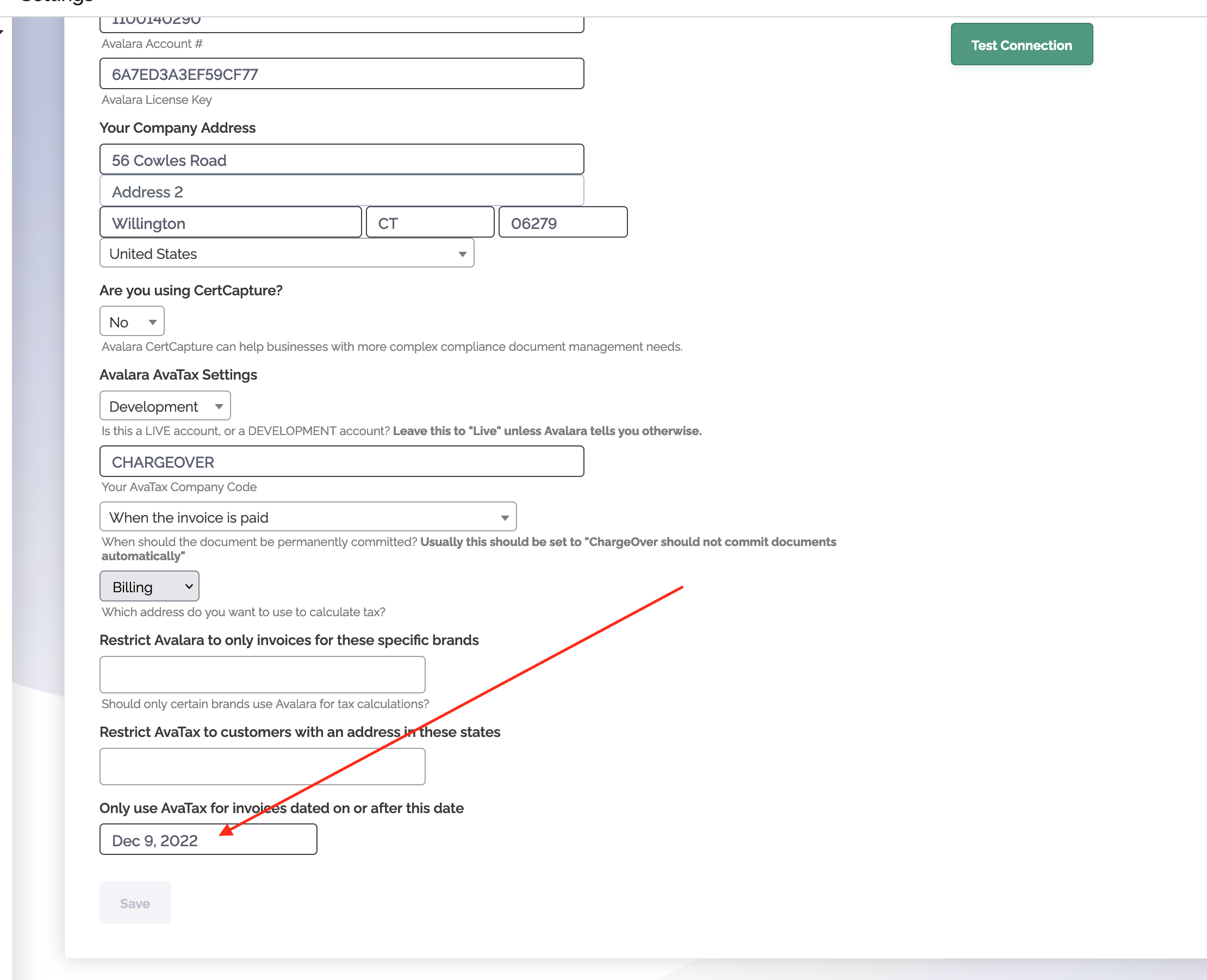

When you are setting up AvaTax in ChargeOver, you will see an option for "Only use AvaTax for invoices dated on or after this date."

You can then choose a date. If you choose to leave the date blank, no taxes will be generated for any invoices.

Example

In the example above, the date chosen is Dec. 9, 2022.

So if an invoice is dated on or after Dec 9, 2022 (the effective date) then AvaTax will calculate tax for it.

Any other invoice dated before Dec 9, 2022, will not have AvaTax calculate tax for it.

AvaTax will NOT calculate taxes before you have chosen a date to start calculating taxes.