Zip2Tax

You may want to connect to Zip2Tax for tax calculations.

Steps to Connect

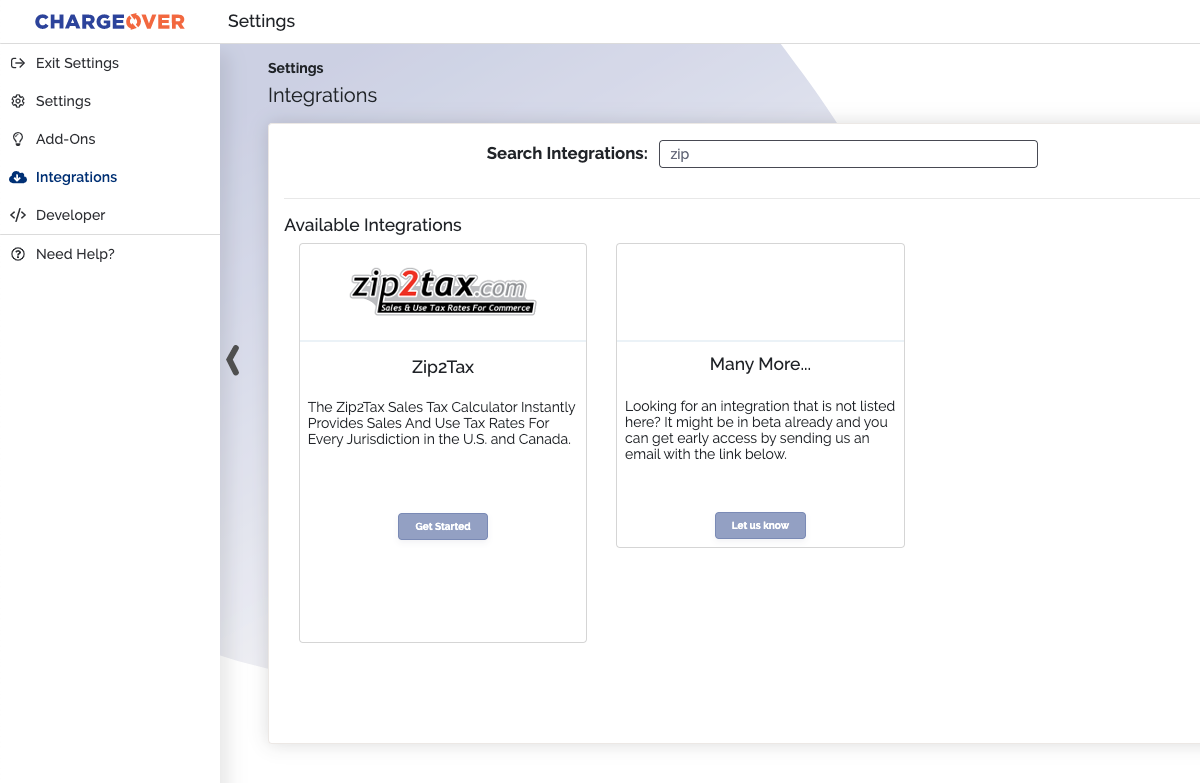

- Go to your settings and select

Integrations then search "Zip2Tax"

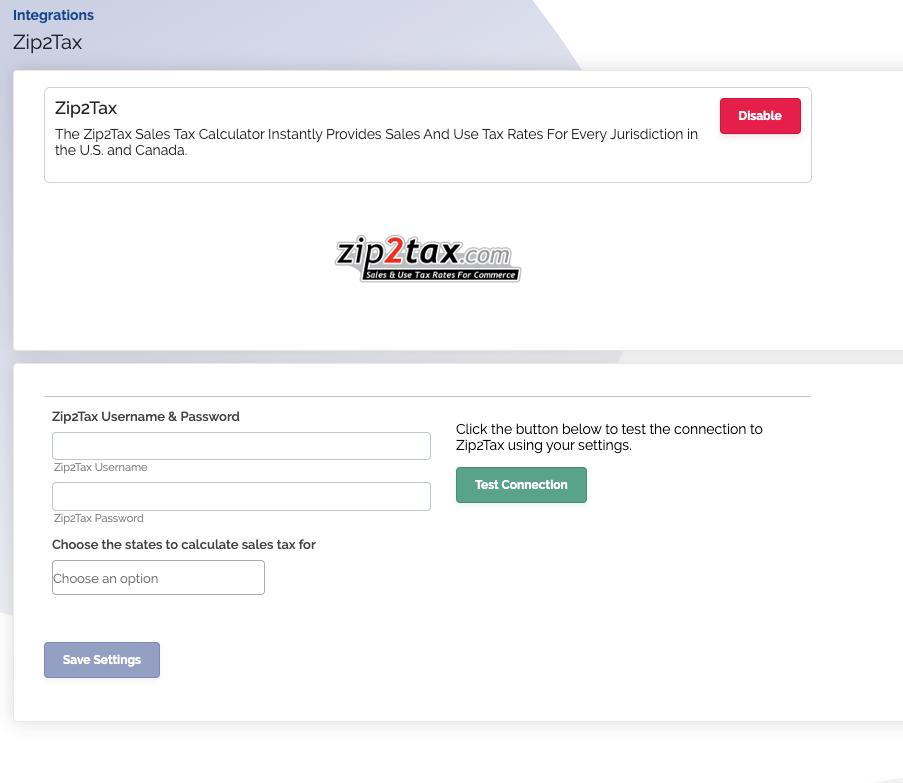

- You will need to provide

- Your Zip2Tax Username and Password

- Which states you charge tax in

- Click the

Test Connection then clickSave Settings

Great, you’re connected!

Tax rates will be automatically calculated for you based on the billing address of the customer, so make sure your customers have a billing address entered.

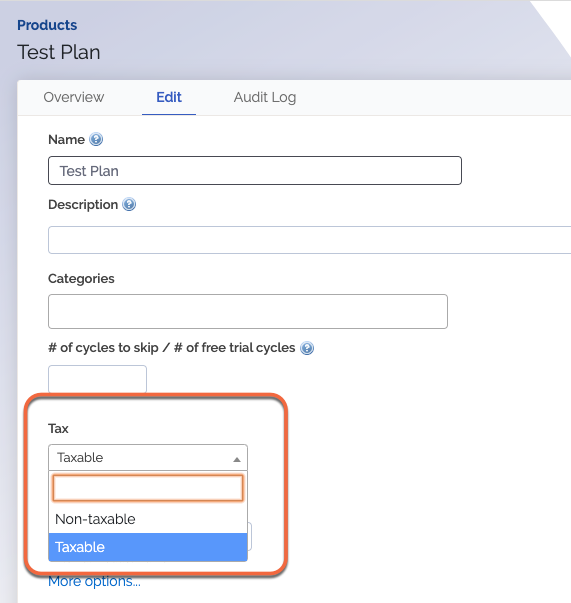

In order for tax to be charged for your products or plans, they must be marked "Taxable."

Apply Tax Rates to an Existing Plan or Product

Go to "Plans and Products" and then select the product you wish to be taxed

Then select the "Edit Plan or Product" tab

Click the "Tax" drop-down and select the tax group you would like to apply to this product (ex: Taxable)

Save Changes

Details of How Tax is Calculated

When ChargeOver calculates tax with Zip2Tax, we follow the following process:

- Grabs the billing or shipping address, depending on your settings

- Ask Zip2Tax for the correct sales tax rate for the postal code

- Saves the tax percentage from that tax rate to the invoice, and calculates the tax from that

ChargeOver calculates tax at the time the invoice is added or edited. The address that exists on the invoice as that time will be used.

If you later edit the customer's address, new invoices will use the new address and thus will calculate tax based on the new postal code.