Vertex Tax Solutions

Overview

Our Vertex integration allows you to automatically generate your tax rates from Vertex and apply them to your ChargeOver invoices.

ChargeOver can utilize Vertex's robust tax configurations to calculate taxes for your invoices. Just configure the connection in ChargeOver and we'll make sure everything is accurate for every line item!

Calculating Taxes

Before ChargeOver can start sending invoices to Vertex for tax calculations, you need to make sure your Vertex account is configured to calculate things as expected. Sign in to your Vertex account here to view documentation.

Once you have configured Vertex taxes and the connection in ChargeOver, you are ready to start sending invoices for tax calculation.

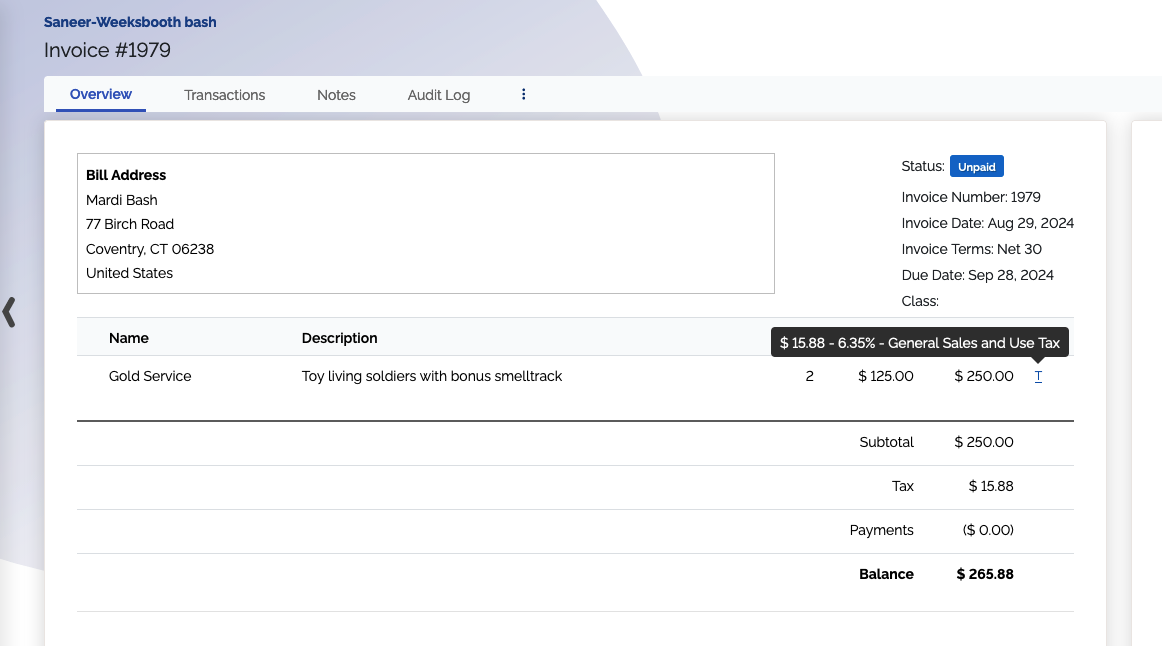

Whenever you create or edit an invoice, we will send it to Vertex to calculate taxes and will automatically apply it to the invoice.

After saving, you'll see the tax reflected automatically.

Just set it and forget it, ChargeOver and Vertex will handle all your taxes for you!

Steps to Connect

In Vertex

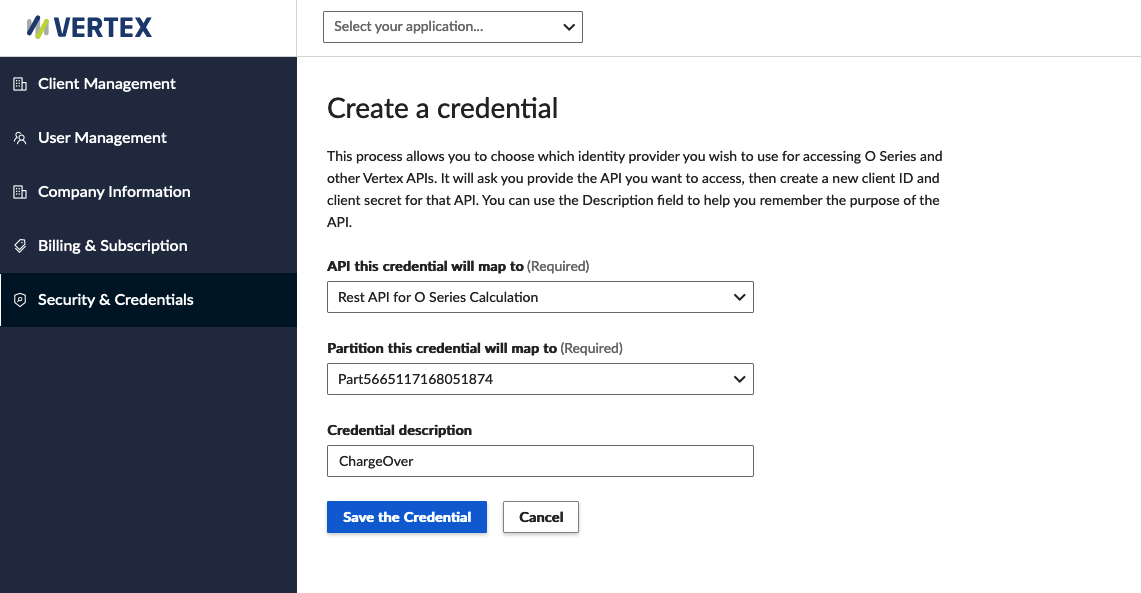

- Log in to your

Vertexportal - From the left-side navigation menu, choose

Settingsand thenView All Credentials - Click the

Create a Credential button to get started- For the

API this credential will map tochooseRest API for O Series Calculation - Choose the correct

Partition(ask Vertex support if you don't know) - Enter

ChargeOverfor theCredential description - Click the

Save the Credential button

- For the

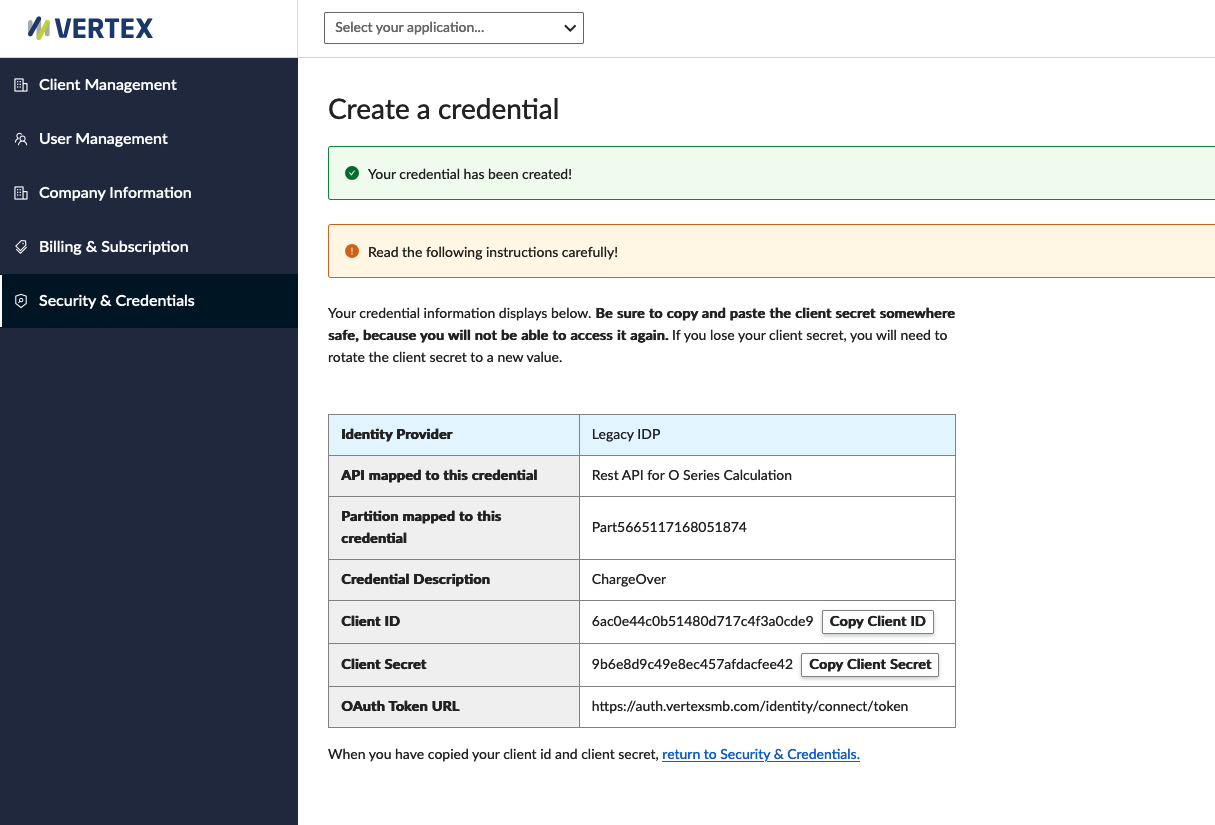

- You will be shown a page with your

Client ID,Client Secret, andOAuth Token URL. Don't leave this page - you will copy these values from this page into ChargeOver on the next step.

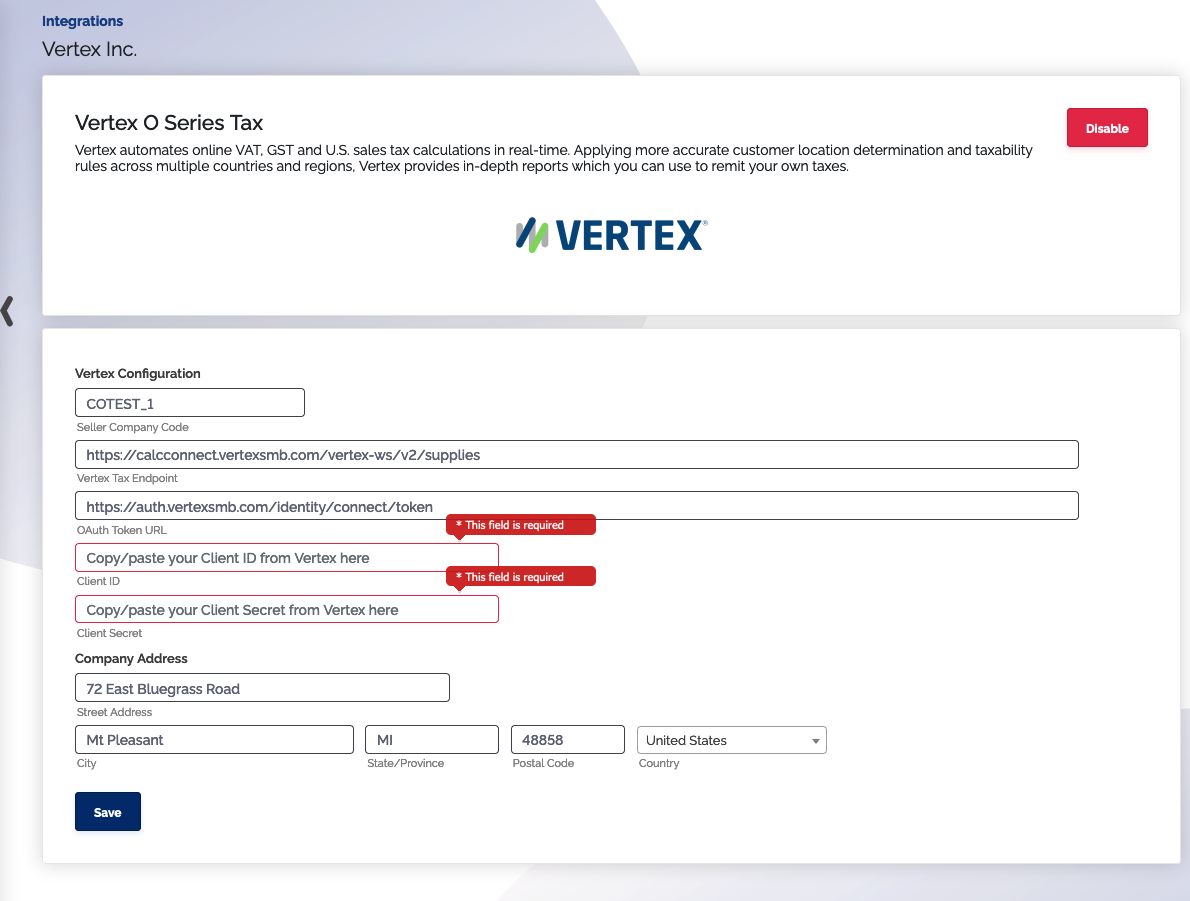

In ChargeOver

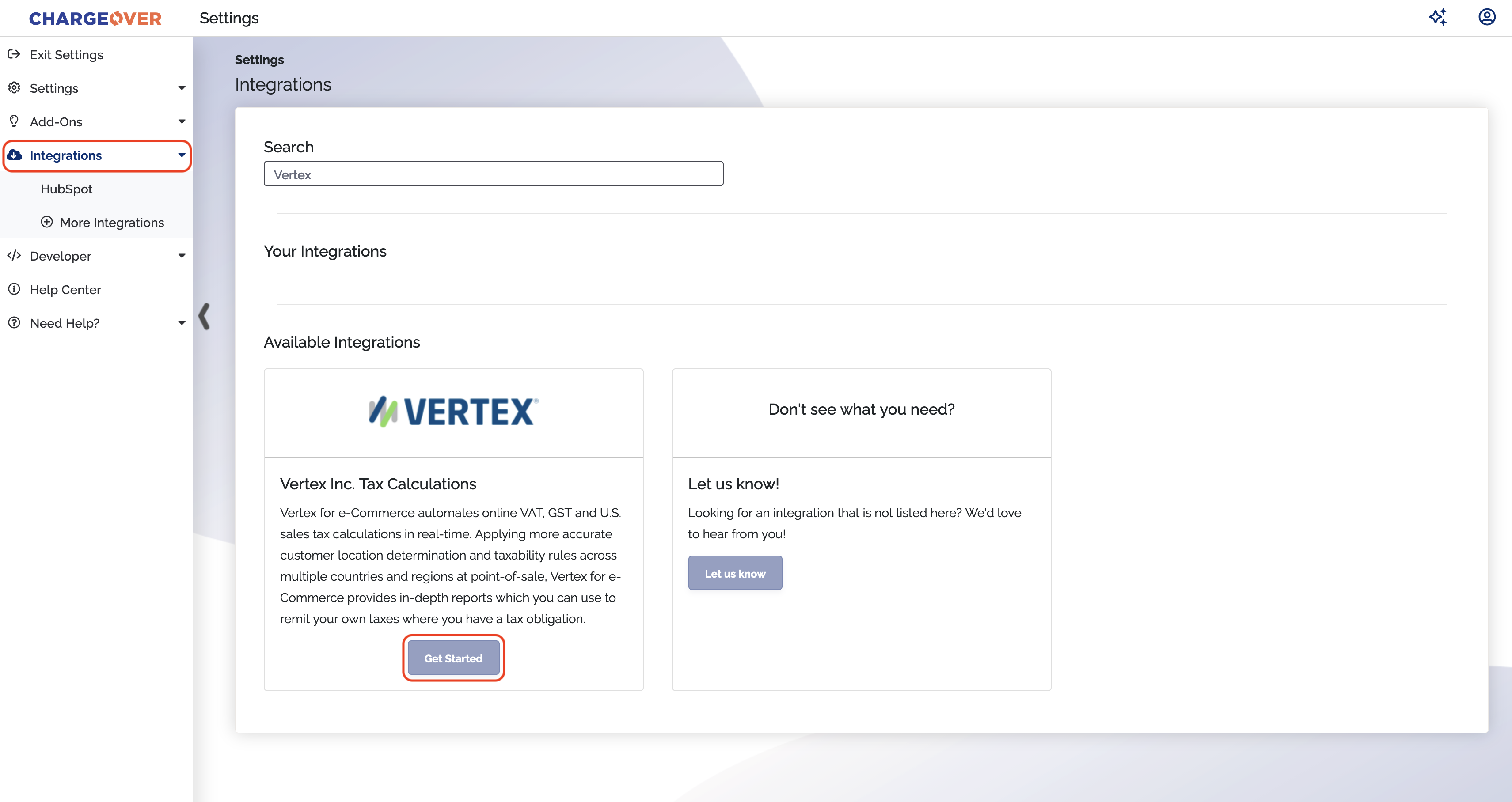

- Go to your settings, then select

Integrations then searchVertex and clickGet Started

- Fill in required information

Seller Company Code(Vertex will supply you with this)Client ID(Copy/paste this from the previous steps in Vertex)Client Secret(Copy/paste this from the previous steps in Vertex)Company Address

- Click

Save

If you need to change the endpoints, please reach out to support to get that information updated.

You're ready to calculate taxes!

Tax calculations with Vertex

Data sent to Vertex

When ChargeOver needs to calculate sales tax, ChargeOver sends a number of pieces of data to Vertex so that tax can be calculated accurately.

This data includes:

- Seller address (your business address)

- Destination address (the customer's billing address)

- ChargeOver's integer customer ID (sent as the Vertex

customerCodeattribute) - Each invoice line item, with...

- The product name (or, if you have a QuickBooks or Xero SKU set, that SKU instead)

- The quantity, rate, and subtotal for the line

- The invoice date

There are some pieces of data that ChargeOver does not send to Vertex currently:

- a Vertex product

productClass - a Vertex customer

classCode - a Vertex

locationCode

Interested in productClass, classCode, locationCode, or other attributes? Contact us!

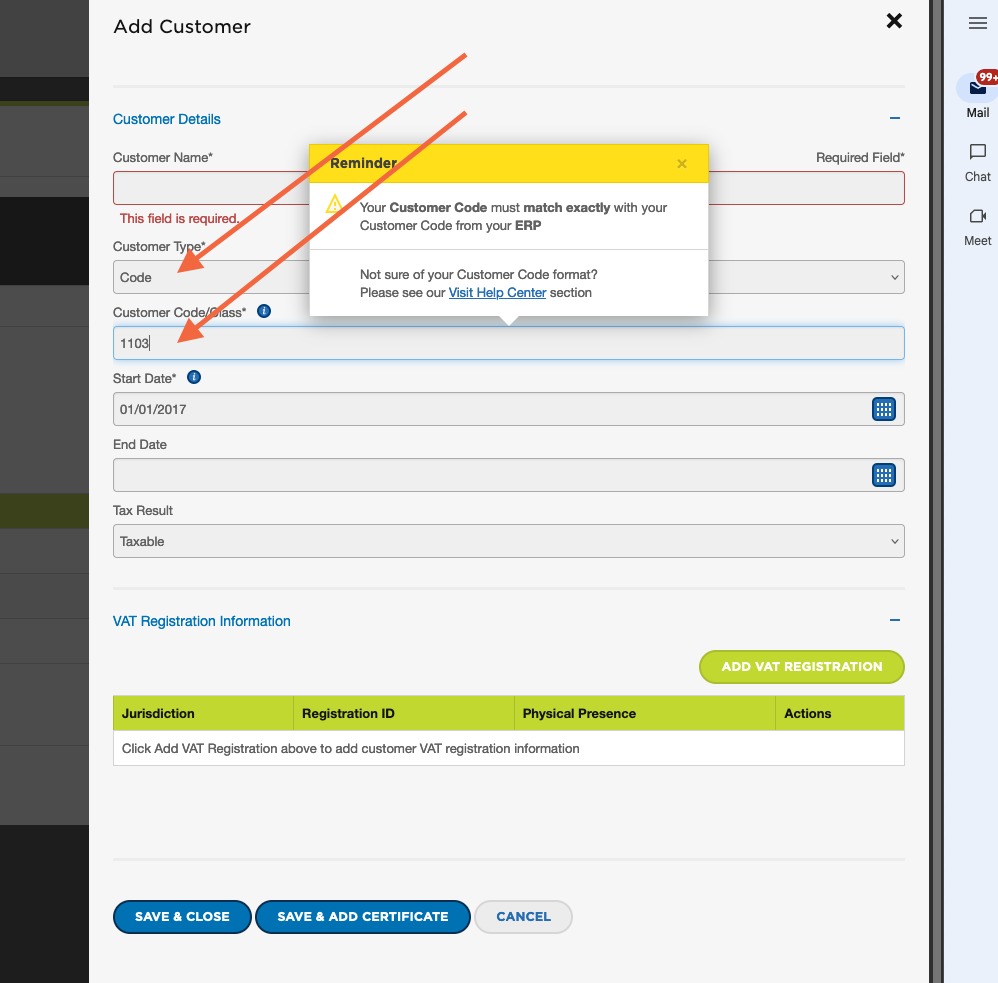

Tax exempt customers

Tax-exempt customers (for example: schools, government agencies, hospitals, etc.) are handled within Vertex. You will mark the customer as exempt from sales tax within Vertex.

When setting up tax-exempt customers, it is important that you:

- Choose

Codefor the VertexCustomer Typefield - Put the ChargeOver

Customer ID #in theCustomer Code/Classfield in Vertex

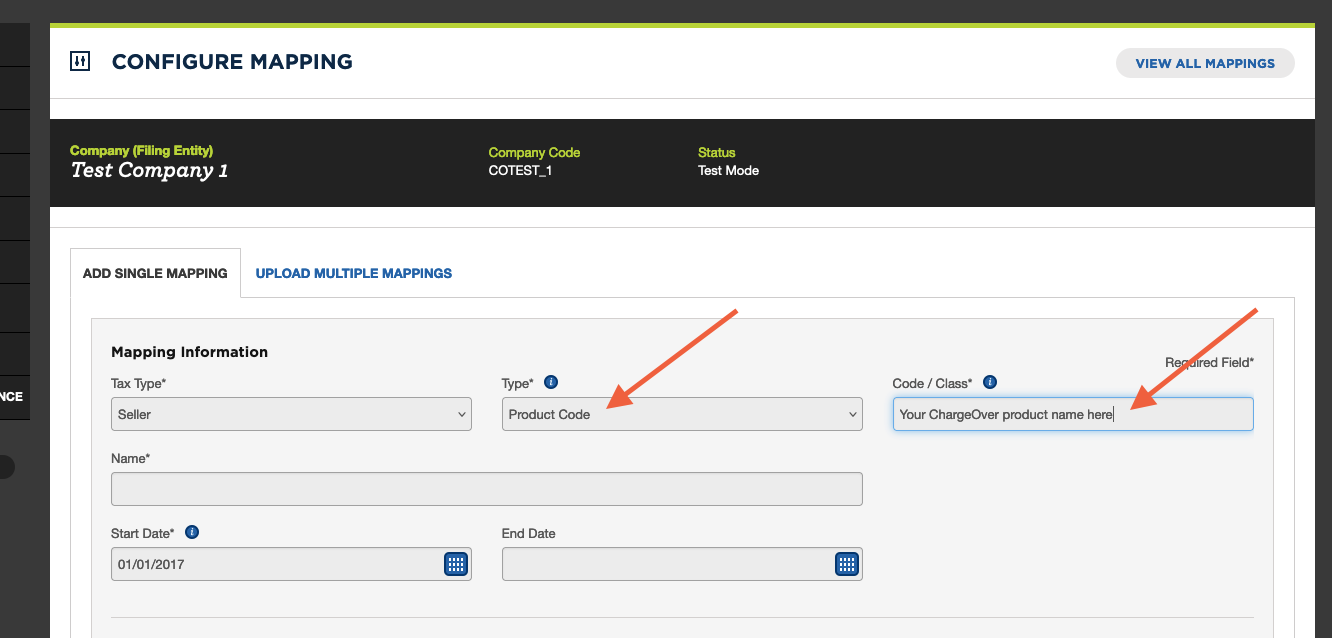

Product mappings

You can map ChargeOver products to particular hats or categories of products within Vertex.

When mapping products, it is important that you:

- Choose

Product Codefor the VertexTypefield - Put the ChargeOver product

NameorQuickBooks or Xero SKUfield for theCode/Classfield in Vertex

Processing fees / surcharges

Due to technical limitations, ChargeOver always sends credit card processing fees and merchant surcharges to Vertex as non-taxable products.