Chargebacks

What is a chargeback?

A chargeback (also known as a reversal) is a form of customer protection provided by the issuing bank, which allows cardholders to file a complaint regarding fraudulent transactions on their statements. Once the cardholder files a dispute, the issuing bank makes an investigation into the complaint.

The consumer may initiate a chargeback by contacting their issuing bank and filing a substantiated complaint regarding one or more debit items on their statement. Once the transaction is proven to be fraudulent, the bank will refund the original value to the cardholder.

From the merchant’s point of view, if you do not prove the transaction to be legitimate, the bank will take back the entire value of the transaction from your account, along with an additional fee.

What do I do?

If you have been issued a chargeback, you should contact your credit card processor and find out what the next steps you should take are. They will likely want documentation showing the correspondence you've had with the customer.

Win credit card disputes

To increase your chances of winning credit card disputes, we have some advice and tips that you can follow.

- Make sure your company name, address, and contact information is accurate, up to date, and visible to the customer.

- If you do business under multiple DBA names, make sure the customer understands this and the company name they see on the invoice and emails match the company name they will see on their credit card statement.

- Have a published (linking directly to it on your website), human-readable (no legal jargon), honest refund/return policy, and honor the policy.

- By offering and honoring a refund/return policy, customers are much more likely to contact you for a return/refund rather than just dispute the charge.

- Respond to customer complaints or requests for refunds/service promptly. Slow response times are more likely to prompt customers to dispute charges.

- If a dispute is initiated, respond to the dispute quickly. Most card processors only allow 7-10 days before the dispute is automatically closed in favor of the customer.

- Provide as much information as possible to your card processor/merchant account. If the customer has contacted you (emailed/called/filed ticket/etc..), you should provide them with this information.

- If you have delivery confirmations, shipping statements, transcripts, etc... your should provide this also.

- The more evidence you can show to indicate you are acting in good faith and have supplied the service/product the customer purchased, the more likely your are to win a dispute.

Audit logs

- Amount of payment

- Date and time payment was made

- Who made the payment (e.g. by you or by the customer)

- What type of payment it was (recurring vs. one-time)

- Information about the invoice including invoice number, how/when the invoice was created

- History of related payments related to the credit card used

- Date and time credit card was entered

- Information about the customers auto-pay history such as when they opted in

- IP addresses and estimated geographical locations of the person making the payment

- Web browser type and signature

- AVS data (address verification)

- CVV date (credit card security code verification data)

- Copies of any emails sent to the customer through ChargeOver

Enable chargebacks

- Go to Settings then

Features thenMore Features - Search for "Chargebacks" and click the

Get Started button - Set "Enable this feature?" to "Yes" and click

Save

Chargebacks are now enabled in your ChargeOver account!

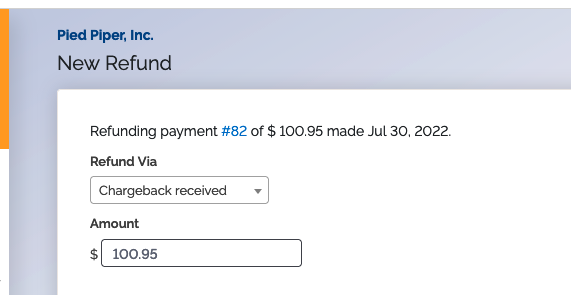

Record a chargeback in ChargeOver

ChargeOver allows you to record chargebacks you have received. Once you enable the Add On, Chargebacks, you get an additional option when recording a refund against a payment.

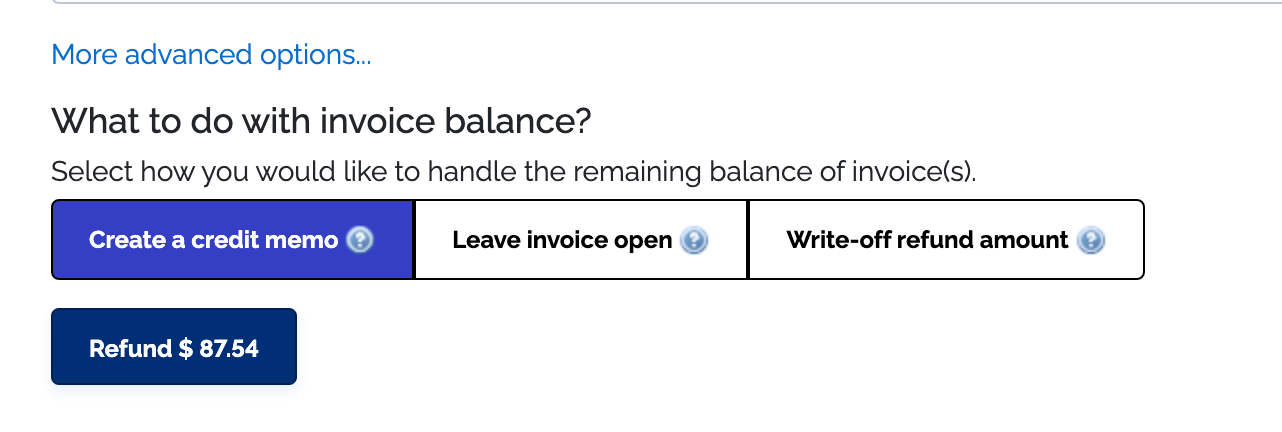

When you record a chargeback, you have options. If you want to charge the customer again for the invoice, make sure to select you want to keep the invoice open. This makes it so that the invoice goes to unpaid after the refund is completed. You will then be given an option to void or write-off the invoice if you can't resolve the issue with your customer.

You can also choose to create a credit and apply that to the invoice to close it out in ChargeOver. The customer will still get their refund and the invoice in ChargeOver will show as "paid" and be closed out.

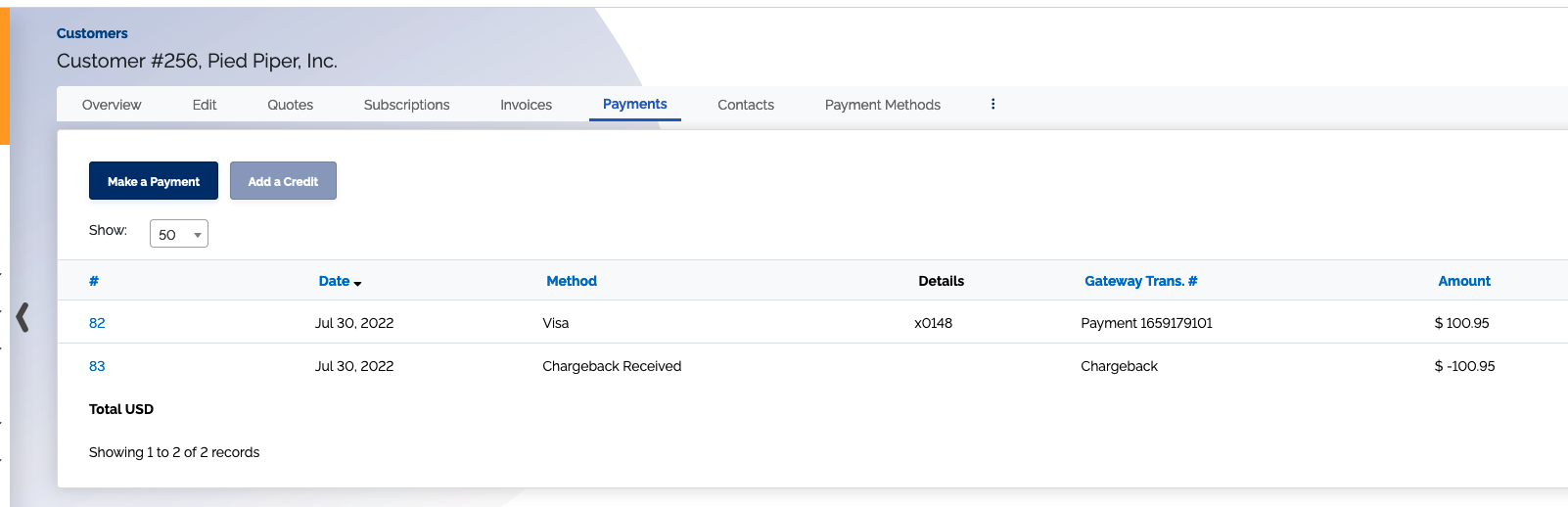

After you record a chargeback, it will be displayed in the customer's list of transactions.

We would be happy to provide you with as much information and detail as possible about your payments in the event you are issued a chargeback. Please contact us for assistance.