Declines and Returns

Credit cards vs. ACH, eCheck or direct debit

With credit cards, the credit card payment is immediately processed by Visa, Mastercard, etc., and you'll get back an immediate success or decline.

Jump to information about:

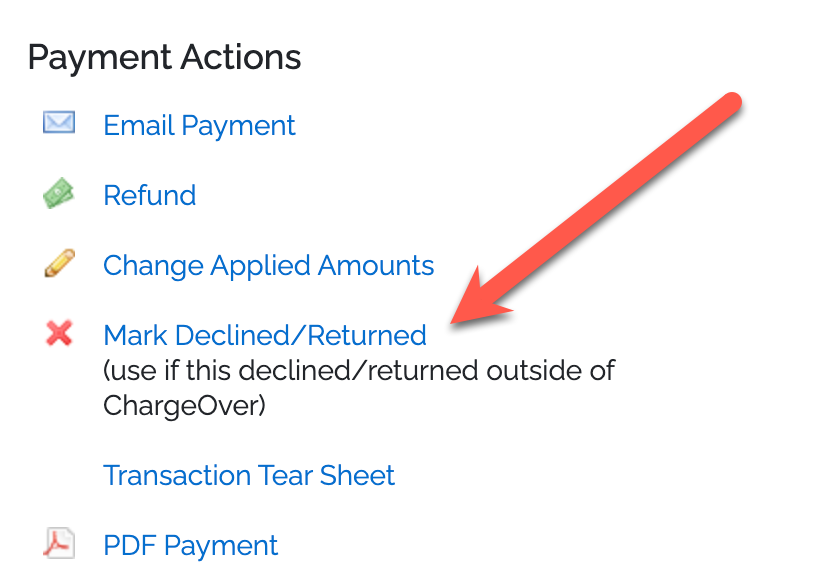

Marking payments as declined

The only payments we show the Mark Declined/Returned option in the payment action sections are on payments where:

The payment method is Check, because we have no way to tell whether manually deposited checks decline or not

The payment method is ACH/eCheck, because for many payment gateways, we don't support pulling the ACH status or the gateway may not allow us to pull the ACH status'

Credit card declines

Credit cards can decline due to many reasons, such as:

- The credit card is expired

- The credit card is over the allowed credit limit

- The credit card is declined as potential fraud

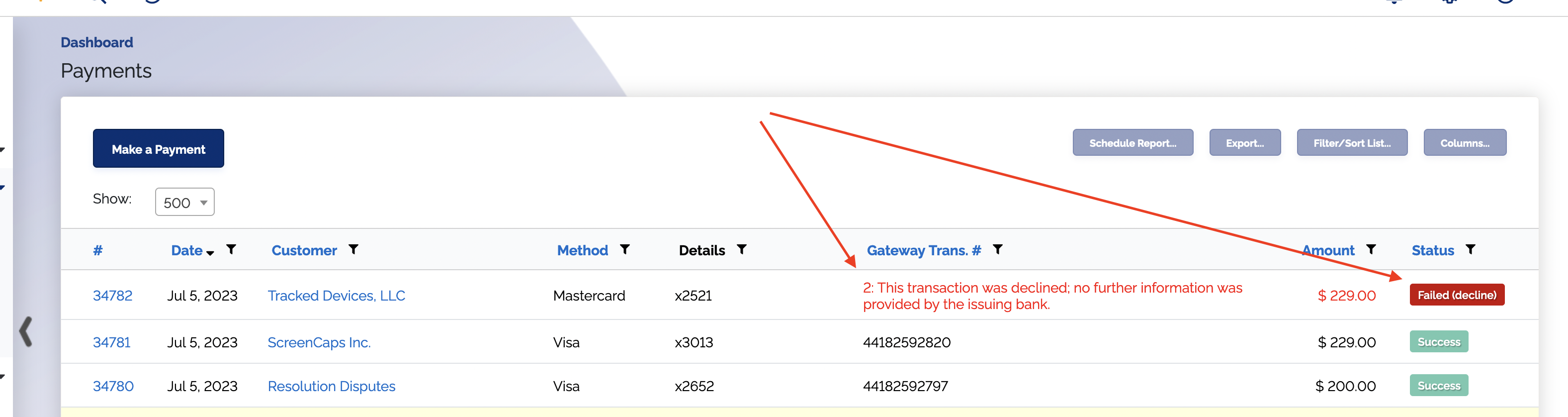

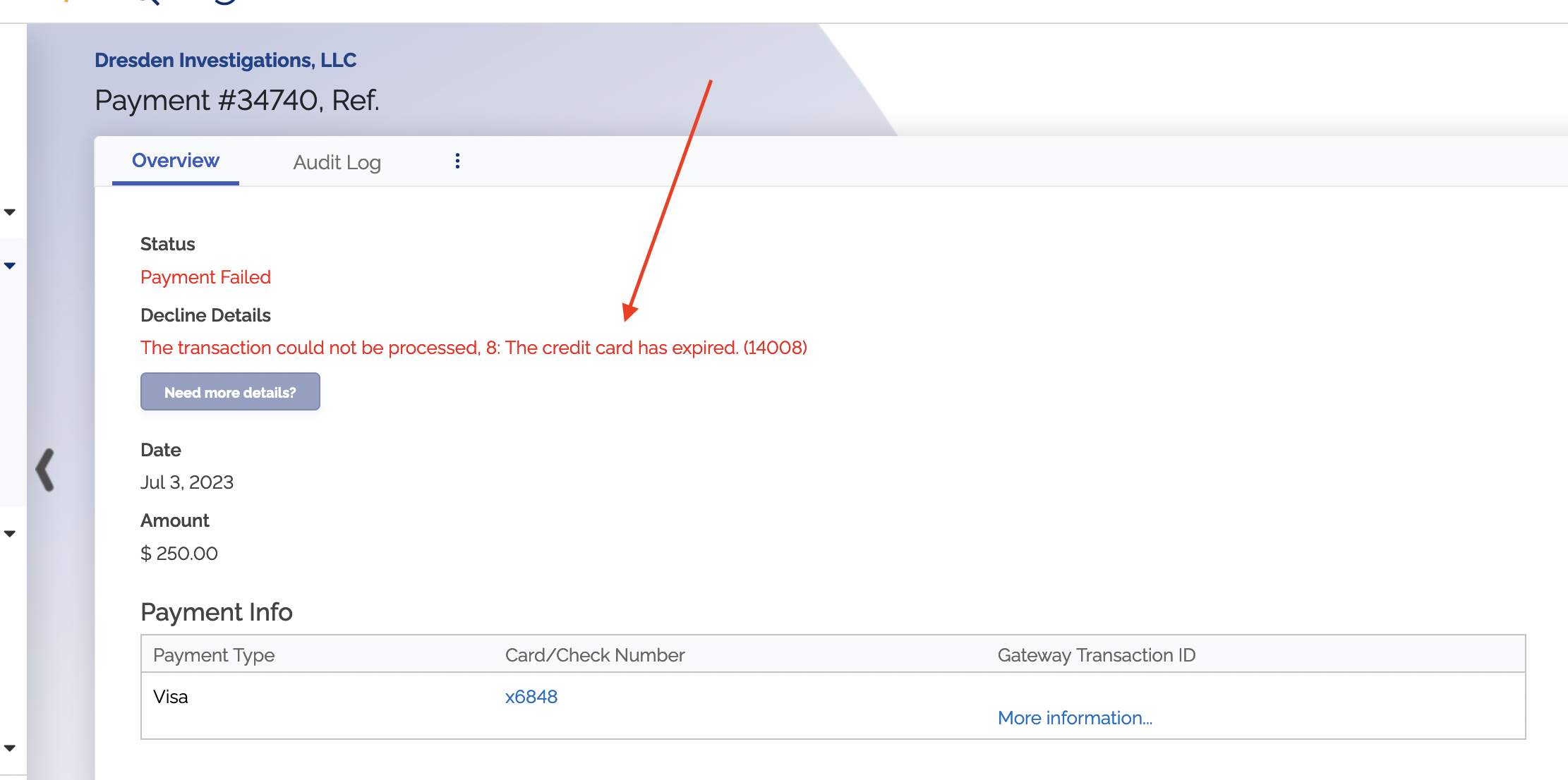

When a card is declined, you'll see the declined transaction in ChargeOver immediately:

ChargeOver will always try to show you as much information as possible about the decline. If you click into the payment, ChargeOver will show you all information available about the decline, and potential resolutions.

Many card issuing banks will not provide a specfic decline reason. This is common, and expected. Contact the cardholder for more details or a new payment method.

ACH, eCheck or direct debit declines

Unlike credit cards, ACH and other bank transfers can take 2 to 5 business days to work their way through the banking system.

ChargeOver supports fetching updated status on ACH transactions from only some payment gateways.

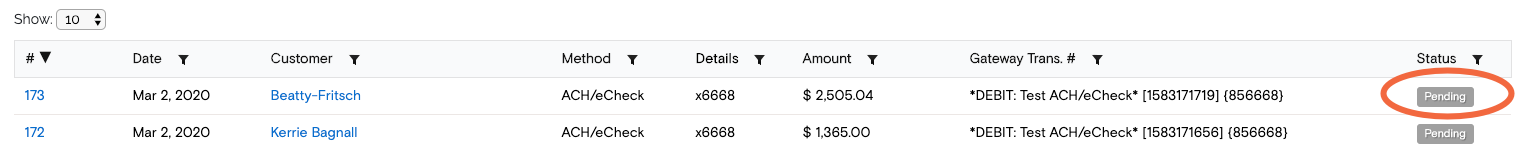

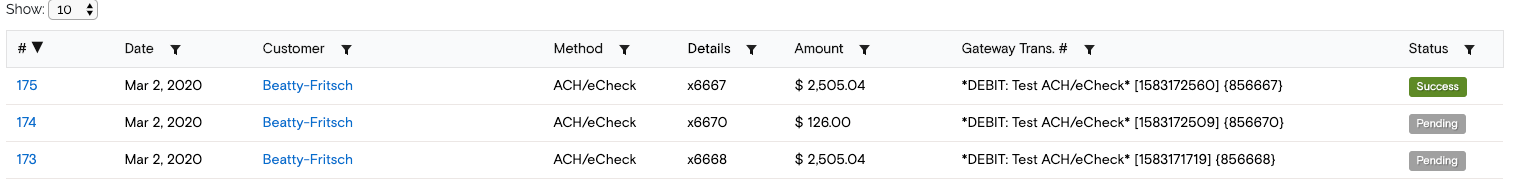

If your payment gateway support this, you'll initially see ACH payments marked with a Pending status in ChargeOver.

This status will change automatically as the payment is processed by the bank. For most transactions, the status will change within 2 to 5 business days, however, ChargeOver will continue to check for status changes and update the payment status for 90 days.

When the payment is accepted and confirmed by the bank, you'll see an updated status of Success.

Alternatively, if the bank rejects the ACH payment (perhaps the customer does not have enough money in their account) you'll see a status that says Failed (declined) instead.

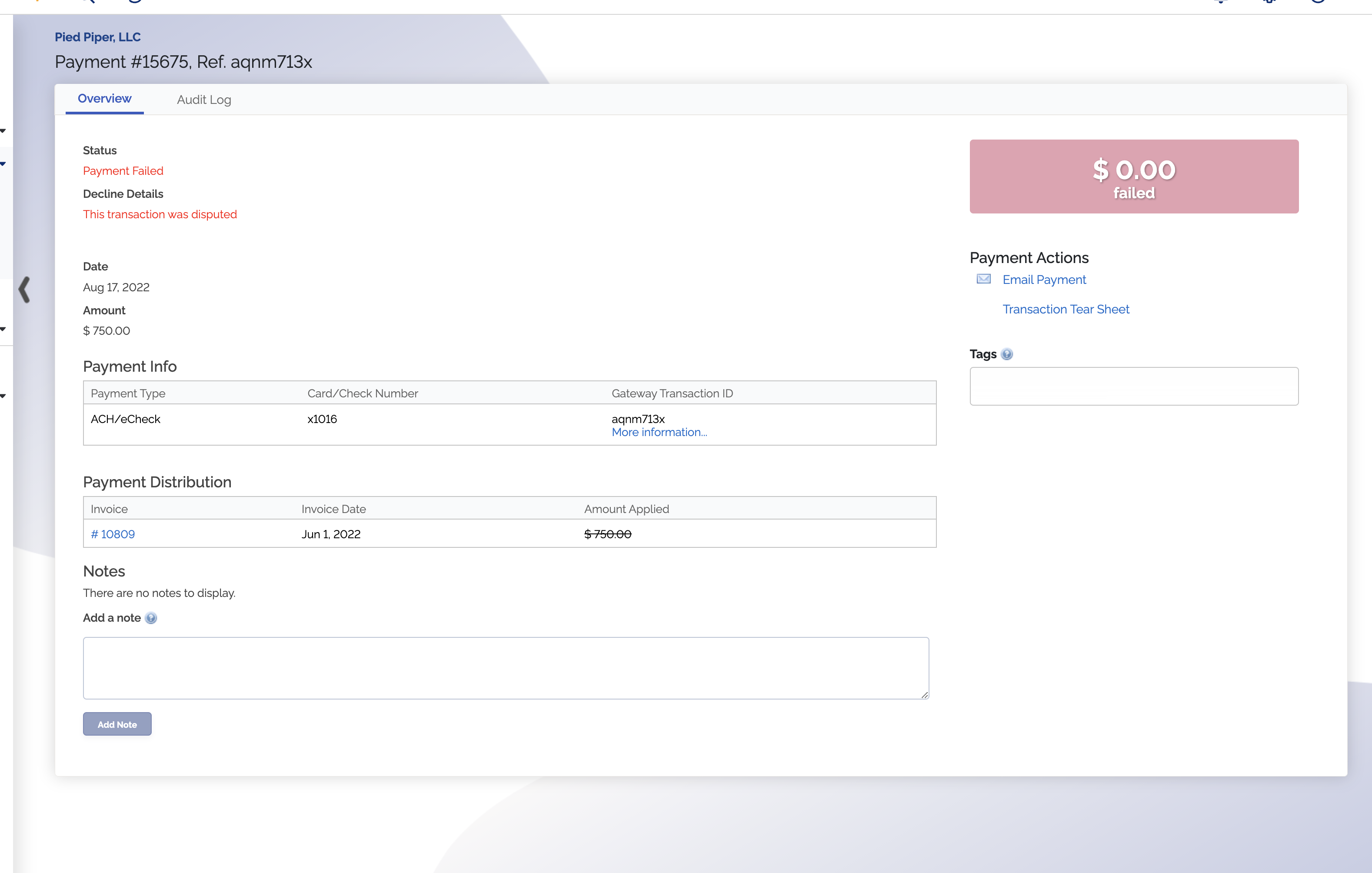

ChargeOver does a few things when an ACH payment is declined:

- We mark the payment as declined or rejected

- We change the invoice balance and status to reflect the rejected payment

- We annotate the payment in ChargeOver with any details provided as to why the payment was rejected

Temporary ACH, EFT,or direct debit returns and declines

Some declines or returns are temporary. For example, the bank account may not have enough money in it to cover the debit. When more money is deposited into the bank account, the account can be debited again.

Permanent ACH, EFT or direct debit returns and declines

When ChargeOver is set to retry failed payments, it will keep attempting to try a declined payment according to the schedule you have set.

However, ChargeOver will only retry payments that have failed due to a temporary issue, such as insufficient funds or general declines. If a card is declined due to a "permanent" failure, and thus there is no chance for future charges to succeed, ChargeOver will not retry the payment.

Below is a list of permanent failures that ChargeOver will not retry and their associated error codes.

| Permanent Error | Code | Developer Info |

|---|---|---|

| Not in accordance with pre-arranged EFT/PAD agreement (This error is specific to Canada) | 13015 | ::ERR_AGREEMENT |

| Incorrect routing/BSB number | 14017 | ::ERR_ROUTING |

| Incorrect account number | 14016 | ::ERR_ACCOUNT |

| Account holder is deceased | 13010 | ::ERR_DEAD |

| Account has been closed | 13011 | ::ERR_CLOSED |

| Account has been frozen | 13012 | ::ERR_FROZEN |

| Bank does not accept ACH/EFT/direct debit payments at all | 13022 | ::ERR_NONPARTICIPANT |

| The issuing bank has stopped the transaction. | 13017 | ::ERR_STOPPED |

| The issuing bank or customer indicates this debit is unauthorized. | 13021 | ::ERR_UNAUTHORIZED |

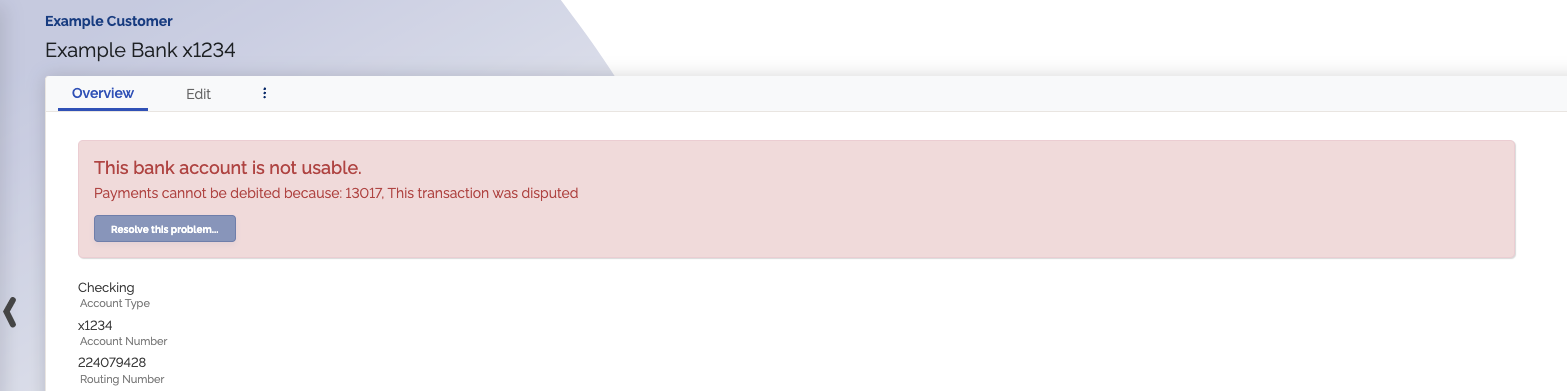

Workflow for retrying ACH payments

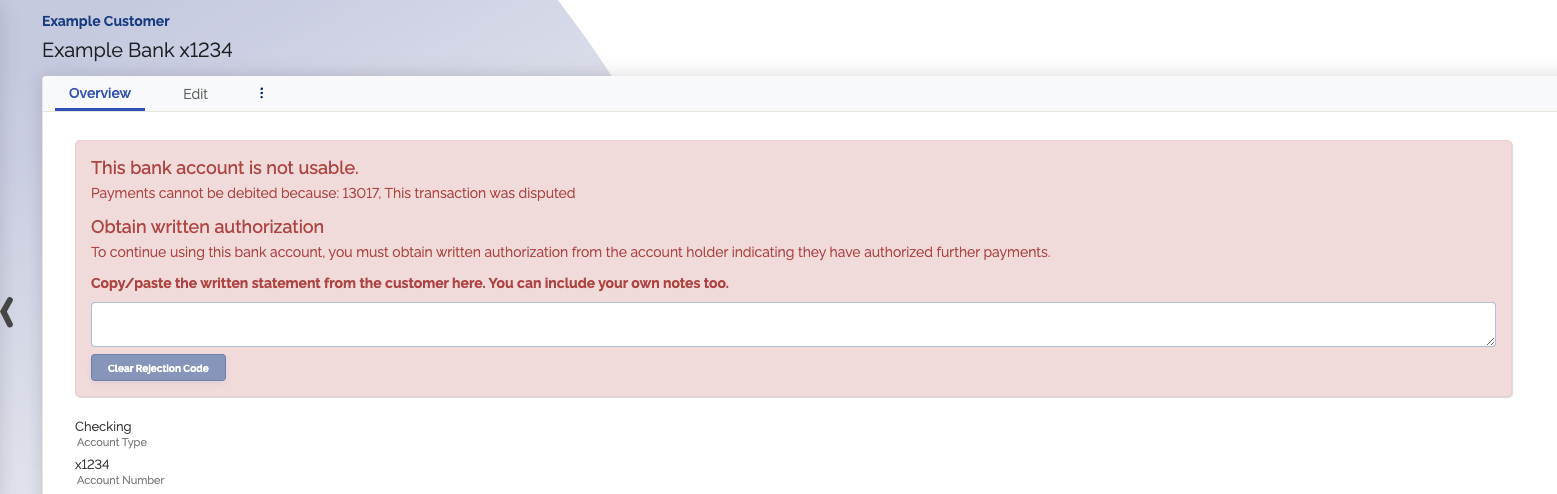

If an ACH, eCheck, or PAD payment is returned or declined for a retry-able with customer agreement reason, you have to either mark the bank account as usable again in ChargeOver or have the customer re-enter the bank account information.

To mark the bank account as usable again in ChargeOver, follow the prompts in ChargeOver, entering what the customer has said.

Error messages indicating payment is not retryable

These are errors that indicate the payment is not retryable. You will need to get a new payment method from the customer to try and charge them again.

- Incorrect account number

- Incorrect routing/BSB number

- Account holder is deceased

- Account has been closed

- Account has been frozen

- Bank does not accept ACH/EFT/direct debit payments at all

Gateways ChargeOver supports returns for

- ANZ Bank

- Authorize.net

- BaseCommerce

- Bank of Montreal

- Bambora

- BlueSnap

- Converge

- Commbiz

- Forte

- Intuit QuickBook Payments

- National Processing

- NMI / Network Merchants

- Stripe

- Rotessa

- USA ePay

We advise against retrying payments an infinite number of times, or very rapidly. Too many retries or rapid retries can result in negative repercussions for your business.

Be careful retrying ACH payments

There are sometimes repercussions when you retry payments too fast. Here are the NACHA guidelines that are constantly being updated.

NACHA allows up to two retries for ACH. For example, after the initial payment fails, you get two retries after to charge a payment. If you go beyond that, you risk being blocked from retrying ACH payments due to NACHA violations.