Closing Dates

Setting a closing date can be helpful for keeping track of financial progress. When you set a closing date in ChargeOver, invoices and transactions cannot be created or adjusted if they are dated on or before the set closing date. That way, financial statements and records before the closing date can be consistent and stable for financial monitoring.

caution

Closing dates are a beta feature. Interested in helping us test? Reach out us at

support@ChargeOver.com

Set a Closing Date

Steps

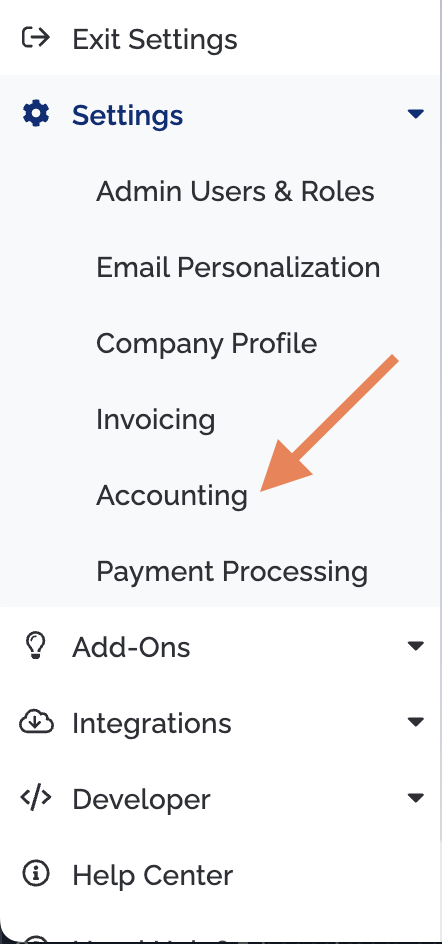

- Go to your Settings, then

Accounting

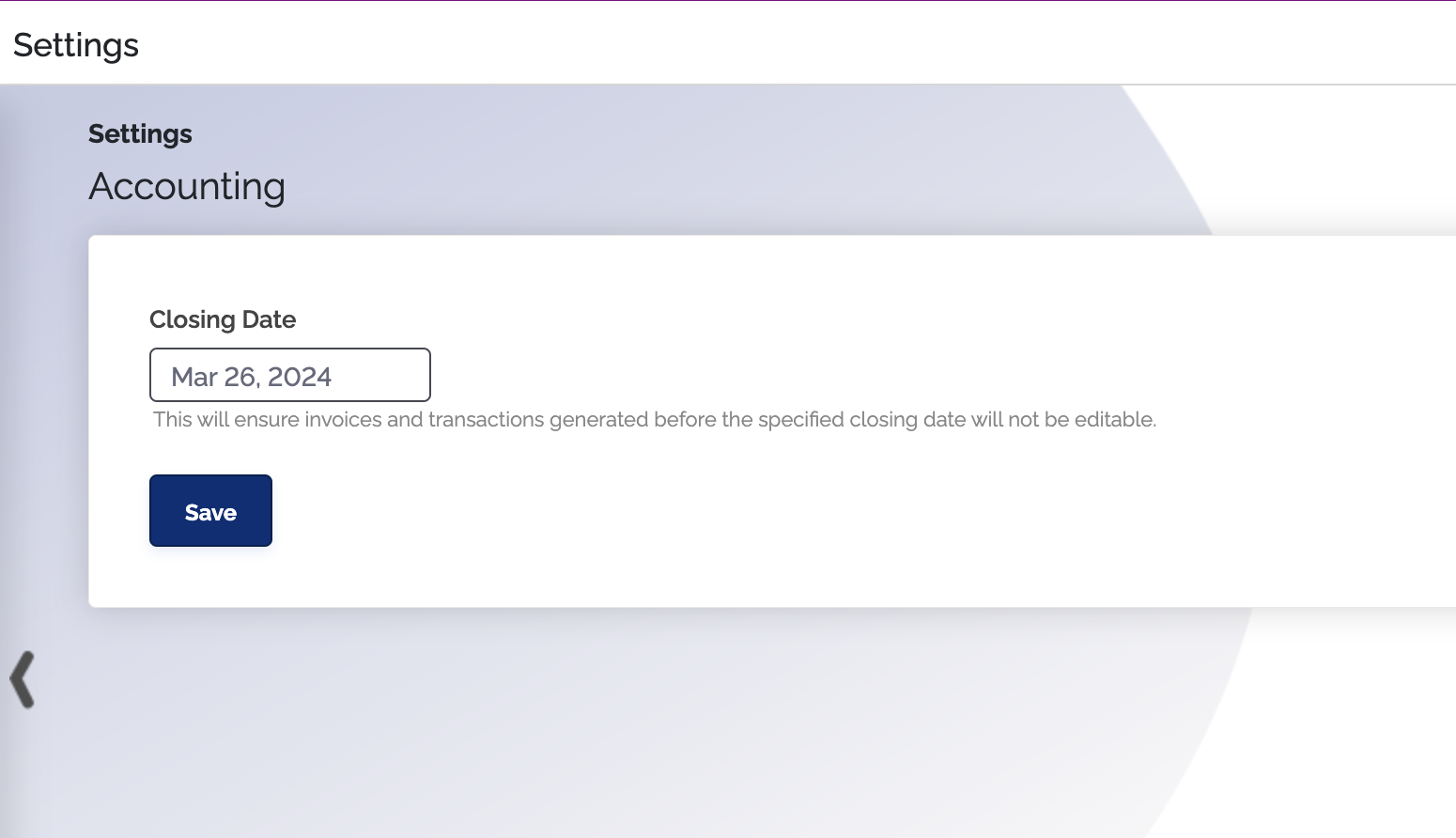

- Select a date you would like to save as the closing date

- Click

Save

Closing Dates and Invoices

- Invoices cannot be created or edited if they have an invoice date on or before a set closing date

- Invoices cannot be backdated to a date on or before a set closing date

- Invoices cannot be voided or unvoided if they have an invoice date on or before a set closing date

- Late fees cannot be added to an invoice if the invoice has a date on or before a set closing date

Closing Dates and Transactions

Setting a closing date will prevent transactions like payments, refunds, credits, and write-offs, from being modified

- Transactions cannot be created if they have a transaction date on or before a set closing date

- Transactions cannot be voided or unvoided if they have a transaction date on or before a set closing date

- Transactions cannot be marked declined if they have a transaction date on or before a set closing date

info

At this time, we don't sync closing dates to Xero or QuickBooks, from ChargeOver.